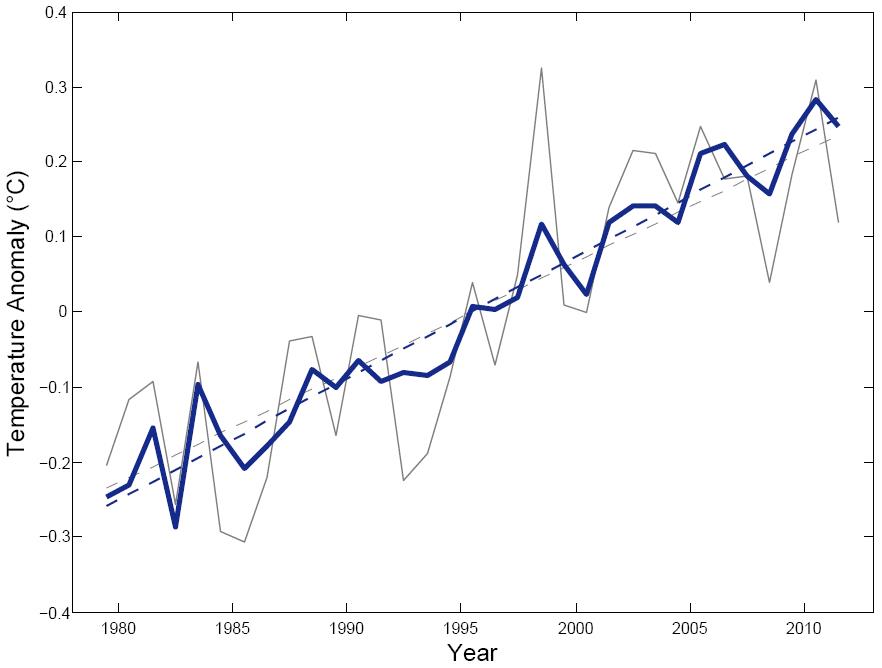

With the election (thankfully, finally!) over and President Obama reelected (hallelujah!), it’s time to start focusing on priorities for a second term. In my mind, other than the country’s economy and fiscal situation, the #1 item on the “to-do” list for the next four years is clearly dealing with climate change. This isn’t just a “special interest,” it’s a grave threat to the planet we all call home. The fact is, if we don’t take strong action very soon, we’re going to be witnessing a lot more storms like Hurricane Sandy, along with melting ice caps, rising sea levels (and acidification of the oceans), mass extinctions (eventually including our own if we’re not careful), and other outcomes too awful to contemplate.

With the election (thankfully, finally!) over and President Obama reelected (hallelujah!), it’s time to start focusing on priorities for a second term. In my mind, other than the country’s economy and fiscal situation, the #1 item on the “to-do” list for the next four years is clearly dealing with climate change. This isn’t just a “special interest,” it’s a grave threat to the planet we all call home. The fact is, if we don’t take strong action very soon, we’re going to be witnessing a lot more storms like Hurricane Sandy, along with melting ice caps, rising sea levels (and acidification of the oceans), mass extinctions (eventually including our own if we’re not careful), and other outcomes too awful to contemplate.

Fortunately, we can do something about all this, and it’s a huge undertaking, but it’s not really that complicated. Simply stated: we need to switch from an economy powered by the carbon-based fuels (coal, oil, natural gas) of the 18th and 19th centuries to one powered by the non-carbon-based energy sources (solar, wind, geothermal, tidal, wave, and of course energy efficiency) of a modern, 21st century economy. The broad question, is mankind capable of rising to this enormous, existential challenge before it’s too late? More specifically, is the our country’s political system capable of doing anything this big?

Here’s the question posed by one of the best thinkers on all this, David Roberts of Grist:

President Obama made a nod to climate change in his reelection victory speech, but does he actually intend to act on the issue in his second term? Will he follow up on his 2008 promise to slow the rise of the oceans, or will he stick with his oil-, gas-, and pipeline-loving “all of the above” energy strategy? And could he get anything through Congress anyway?

My answer: an “all of the above” energy strategy may sounds good to focus groups, but it doesn’t keep the planet inhabitable for generations to come. It’s time we get serious and stop goofing around here, which is what we’ve been doing.

Thus, in the first term, we had a convoluted effort, hijacked in large part by fossil fuel industries, to put a price on carbon in a convoluted, roundabout way, with massive subsidies to fossil fuel corporations thrown in to sweeten the deal. This was the core conservative idea, now bizarrely demonized by conservatives, called “cap and trade.” Unfortunately, although there’s a lot to say for that conservative idea, once it got into the “sausage factory” of our political system, it turned into something truly ugly. And then it didn’t pass anyway. Lose-Lose.

So, why didn’t we just put a price on carbon directly, via a carbon tax, revenue neutral or not? Simple: neither party wanted to say the word “tax,” let alone be seen by voters as imposing one on them. Ergo, the smoke-and-mirrors cap-and-trade scheme (a too-clever-by-half move idea from conservatives if we’ve ever seen one), which Republicans quickly relabled as “cap and tax,” thus putting the dreaded “t” word in there and turning it into political poison, despite all the convolutions. In sum, “cap and trade” turned into the worse of all worlds – overly complicated, too many giveaways to corporations, labeled a “tax” anyway, AND didn’t pass! Well, that idea’s dead and buried now, so what next?

My proposal is simple: let’s go back to the core concept here and not get overly complicated: simply put a TAX on the bad stuff you don’t want (e.g., pollution), while lowering taxes on the good stuff you DO want (e.g., savings, income). Thus, a carbon tax, one which can be 100% revenue neutral if we want (just give back all the proceeds from the tax in a fair manner to the American people), or partly revenue neutral (e.g., only give back money to those making under a certain income threshold, let’s say $250,000 a year, while using the rest of the money for clean energy R&D, home and business energy efficiency, etc.).

But wait, you say, wouldn’t anti-taxers like Grover Norquist oppose this, and wouldn’t this violate Barack Obama’s pledge not to raise taxes on those making under $250,000 a year? On the first point, let’s face it, Norquist isn’t likely to support anything reasonable on any subject, as he’s a my-way-or-the-highway extremist. We simply need to marginalize that guy – and others, like the Chamber of Commerce, who do the fossil fuel industry’s bidding – to the extent possible. But for reasonable, sane Republicans, the concept of taxing a “bad,” making polluters pay, and correcting a clear market failure (by internalizing a massive externality), should be eminently reasonable and consistent with conservative philosophy (note: there used to be reams of environmentally responsible Republicans, from Teddy Roosevelt through Richard Nixon through George HW Bush…).

As for Obama’s won’t-raise-taxes-on-the-middle-class pledge: as stated above, there’s no reason why people earning under $250,000 per year can’t be given back every penny of the carbon tax – whether in cash and/or in subsidies for solar panels, home energy retrofits, etc. – so that it’s NOT a net tax increase. So much for that problem.

Three final points. First, in addition to saving earth’s environment from certain catastrophe, putting a price on carbon will send tremendously powerful signals to entrepreneurs, venture capitalists, investors, corporations, etc. that clean energy – wind, solar, etc. – is the way to go, while dirty energy – coal, oil, and to a lesser extent natural gas – are far less so. This should jump start a massive explosion in clean energy – an industry that’s already doing well regardless – that will quickly transform our economy to one powered by clean, domestic, inexhaustible, job-creating, non-carbon-emitting energy sources. Second, in the context of reforming our country’s tax structure, we should use carbon as the model for taxing “bads” (e.g., pollution, shipping jobs overseas, sprawl, wahtever) and rewarding “goods” (clean energy, building businesses in America, smart growth). Finally, we should seriously consider using a carbon tax as a way to simultaneously slash our country’s deficit while investing in the clean energy economy of tomorrow. That would be a tremendous win-win-win, giving us a cleaner and healthier, more secure, and more economically prosperous country for the foreseeable future. Other than the entrenched fossil fuel interests and the politicians they’ve bought and paid for, who would be against this? Got me.

Sign up for the Blue Virginia weekly newsletter

Sign up for the Blue Virginia weekly newsletter

![Tuesday News: “For Biden, Aid Package Provides Welcome Boost on the World Stage”; Biden the Big Winner of This Congress; “A potential reckoning [Trump’s] spent a lifetime eluding could be coming.”; Abigail Spanberger Will Be the Dems’ 2025 VA Gov Nominee](https://bluevirginia.us/wp-content/uploads/2024/04/bidenbigwinner-238x178.jpg)