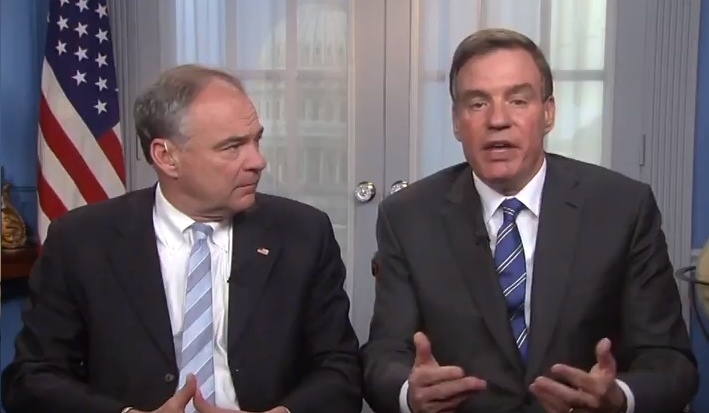

From Senators Mark Warner and Tim Kaine:

WARNER & KAINE STATEMENT ON ONE YEAR ANNIVERSARY OF PRESIDENT BIDEN’S SIGNING OF AMERICAN RESCUE PLAN

WASHINGTON, D.C. – Today, Senators Mark R. Warner and Tim Kaine issued the following statement to mark the one-year anniversary of President Biden signing the American Rescue Plan (ARP)—COVID-19 relief legislation they helped pass into law:

“Thanks to the American Rescue Plan, we’re on our way toward a comeback after COVID-19. Virginians in every community experienced firsthand the benefits of this legislation, from direct payments for families and easier vaccine access, to support for schools and child care centers. We wouldn’t be where we are today without these investments, and we’re going to keep working to build on the progress we’ve made over the last year.”

ARP was first introduced in the Senate in March 2021, and was ultimately passed by 50 Democratic Senators and a tiebreaking vote by Vice President Kamala Harris. The legislation funneled critical resources to communities throughout Virginia to help the economy recover after the pandemic. When ARP passed, the unemployment rate was 6 percent. Since then, it has dropped to 3.8 percent.

Investments the legislation made in Virginia priorities include:

Assistance for Virginia households:

- The bill provided advanced expanded Child Tax Credit (CTC) payments – tax cuts for parents – that benefited 1.6 million Virginia children, including more than 200,000 children living below the poverty line. The vast majority of families in Virginia received $3,000 per child ages 6-17 years old and $3,600 per child under 6 as a result of the increased 2021 Child Tax Credit.

- Expanded Earned Income Tax Credit (EITC) payments for childless workers boosted earnings for more than 400,000 Virginia workers. The ARP nearly tripled the EITC to roughly $1,500 for workers without children.

- The legislation also included additional funding for emergency rent and utility relief—which has now provided over $500 million to help keep Virginia families in their homes and keep utilities from being shut off during the pandemic.

Child care: Virginia received $488 million to help child care providers stay open and ensure families have access to affordable child care options so they can return to work. The expanded Child and Dependent Care Tax Credit has provided working Virginia parents with relief from the high cost of child care. Virginia families with incomes below $125,000 will get back up to half of what they spent on child care in 2021 while working or studying—saving up to $4,000 for one child or $8,000 for two or more children under age 13. Families earning up to $438,000 will get a partial credit.

State, local, and tribal aid: The legislation provided $7.2 billion for state and local aid for Virginia. This funding helped Virginia continue to take public health measures and address the negative economic effects of COVID while also including more flexibility to help local Virginia governments experiencing revenue shortfalls prevent budget cuts. Some examples of how Virginia communities are putting this funding to use include:

- $250 million for ventilation improvements in public school facilities to decrease the risk of COVID-19 transmission and support safe schools across Virginia.

- $700 million for broadband deployment across Virginia, which will result in universal broadband coverage in the Commonwealth by 2024, four years earlier than predicted.

- $8.6 million to help Frederick County participate in a regional project to develop fiber-to-the-home broadband service. This put broadband within reach for roughly 42,700 previously unserved locations in the region.

- $3.7 million for Virginia Beach to provide 65 emergency rental vouchers to help households at high risk of housing instability afford rent. The program will expand on the 35 vouchers previously awarded to the city through federal programs.

- $1 million for Prince William County to support the costs associated with the COVID-19 emergency response program, including community vaccination efforts.

- $600,000 for Albemarle County to provide emergency shelter and permanent supportive housing to individuals experiencing homelessness.

- $570,000 for Danville to provide utility assistance to 1,300 households that were financially impacted by the pandemic. This assistance aims to prevent residents from being displaced due to unpaid utility costs.

- $560,000 for Alexandria to use for workforce development programs. These programs incorporated work-based learning, vocation-based English for Speakers of Other Languages (V-ESOL) training, digital literacy and equity for employment, and included access to supportive services. Participants will earn as they learn, and hosting companies will receive support and a chance to assess a good fit before making a hiring decision on a prospective employee.

Health care provider mental health: The bill included over $100 million, including over $5 million for Virginia, to boost mental health support for front line health workers. This funding was modeled after the Dr. Lorna Breen Health Care Provider Protection Act, legislation Kaine sponsored in honor of a physician from Charlottesville, Virginia, who died by suicide after working on the frontlines of the pandemic in New York. The Breen Act subsequently passed the Senate in February 2022.

Higher education: Virginia received over $948 million for 120 colleges and universities, including $297 million for community colleges due to the American Rescue Plan—much of which will provide financial relief to students. For a more in depth breakdown of Virginia higher education funding, including funding for community colleges, HBCUs, and MSIs, click here.

Expanding health care access: The legislation included a two-year authorization of provisions from Kaine’s Medicare-X Choice Act to help low- and middle-income Americans pay their health care premiums by providing a larger tax premium subsidy for Americans living below 400% of the Federal Poverty Level (FPL) and expanding tax credit eligibility to families above 400% of the FPL. Kaine continues to advocate for the passage of his legislation to make those changes permanent. In Virginia, over 307,000 people are now seeing reduced health care costs through the Health Insurance Marketplace, a 18% increase since the American Rescue Plan passed.