See below for a press release from the White House Press Office, as well as a new analysis from the U.S. Treasury, which finds “three key conclusions”:

- “The United States has seen a particularly strong GDP recovery and is on track this year to reach the level that would have been predicted by the pre-pandemic trend.”

- “Global labor markets continue to strengthen, and the United States has been especially resilient.”

- “U.S. inflation has cooled sooner and more quickly than in other advanced economies.”

Also note this morning’s report on third quarter GDP, which found amazing 4.9% growth in the third quarter. Bottom line: the U.S. economy now is growing rapidly, near 50-year-low unemployment rates, and with inflation at just 3.7%, yet somehow, many people think things are much worse than that? I heavily blame the media for doing a HORRIBLE job conveying facts and reality to their readers/viewers/listeners…

FOR IMMEDIATE RELEASE

October 26, 2023

WASHINGTON – Today, the U.S. Department of the Treasury released an analysis of data from the IMF’s latest World Economic Outlook and other international sources that shows that the U.S. economy continues to outpace global peers and has exhibited more strength than forecasters anticipated throughout 2023 along three key dimensions: growing economic output, labor market resilience, and slowing inflation. The progress we have made on growth, labor markets, and inflation stands out across the globe, and remains an important source of strength for the global economy.

The resilience of the entire global economy is a testament to the President’s economic plan, as well as our work with partners around the world to effectively coordinate efforts to recover from the pandemic and support the global economy. In particular, the U.S. policy environment is a clear contributor to U.S. economic performance. The Biden Administration’s focus on supply-side measures via the Bipartisan Infrastructure Law, the CHIPS and Science Act, and the Inflation Reduction Act is working to expand our productive capacity to create space for faster growth without stoking inflation. Indeed, the October 2023 IMF World Economic Outlook attributes the improved global outlook partly to the strength of the United States economy. Our supply-side investments are not just bolstering the U.S. economy but supporting the global economic outlook as well.

Key takeaways from the analysis:

- The United States has seen a particularly strong GDP recovery and is on track to return to pre-pandemic trend growth this year.

- Global labor markets continue to strengthen, and the United States has been especially resilient.

- U.S. inflation has cooled sooner and more quickly than in other advanced economies.

Stronger-than-expected U.S. growth continues to drive surprises to the upside in global growth in 2023, and the IMF notes that the likelihood of a hard landing has receded and the downside risks from last spring have moderated. While risks for the U.S. economy remain, the progress we have made underscores the value of a swift and growth-oriented policy response while making important investments in our economy’s long-run productive capacity.

The full report is available here.

****************

Eric Van Nostrand, Acting Assistant Secretary for Economic Policy

Tara Sinclair, Deputy Assistant Secretary for Macroeconomics

The U.S. economy in 2023 outperformed expectations along three key dimensions: growing economic output, labor market resilience, and slowing inflation. This month, the IMF released its latest World Economic Outlook (WEO), which provides an important occasion to consider U.S. economic performance in the context of the global outlook. The progress we have made on growth, labor markets, and inflation stands out across the globe, and remains an important source of strength for the global economy.

The resilience of the entire global economy is a testament to the international cooperation and policy coordination that continues to help us recover from the pandemic. In particular, the U.S. policy environment is a clear contributor to U.S. economic performance. The Biden Administration’s focus on supply-side measures via the Bipartisan Infrastructure Law, the CHIPS and Science Act, and the Inflation Reduction Act is working to expand our productive capacity to create space for faster growth without stoking inflation. Indeed, the October 2023 WEO attributes the improved global outlook partly to the strength of the United States economy. Our supply-side investments are not just bolstering the U.S. economy but supporting the global economic outlook as well.

We offer three key conclusions:

- The United States has seen a particularly strong GDP recovery and is on track this year to reach the level that would have been predicted by the pre-pandemic trend.

- Global labor markets continue to strengthen, and the United States has been especially resilient.

- U.S. inflation has cooled sooner and more quickly than in other advanced economies.

Advanced economies faced different shocks and challenges than the United States. Economies heavily dependent on Russian energy imports were hit hardest by the war in Ukraine with steeper increases in energy prices and a sharper slowdown. As the WEO notes, the euro area suffered an adverse terms-of-trade shock in part due to the energy shock. The WEO also cites analysis showing that the pass-through effects from energy shocks associated with external factors have been a larger driver of core inflation in Europe than in the U.S. Consequently, comparisons across diverse economies must be done carefully. Indeed, many foreign advanced economies have similarly surprised forecasters to the upside. And many risks to the U.S. outlook remain, including tighter credit, persistent uncertainty over government funding, and ongoing autoworker strikes. But across growth, labor, and inflation, the United States’ resilience remains an important source of global economic strength.

STRONG U.S. GDP RECOVERY

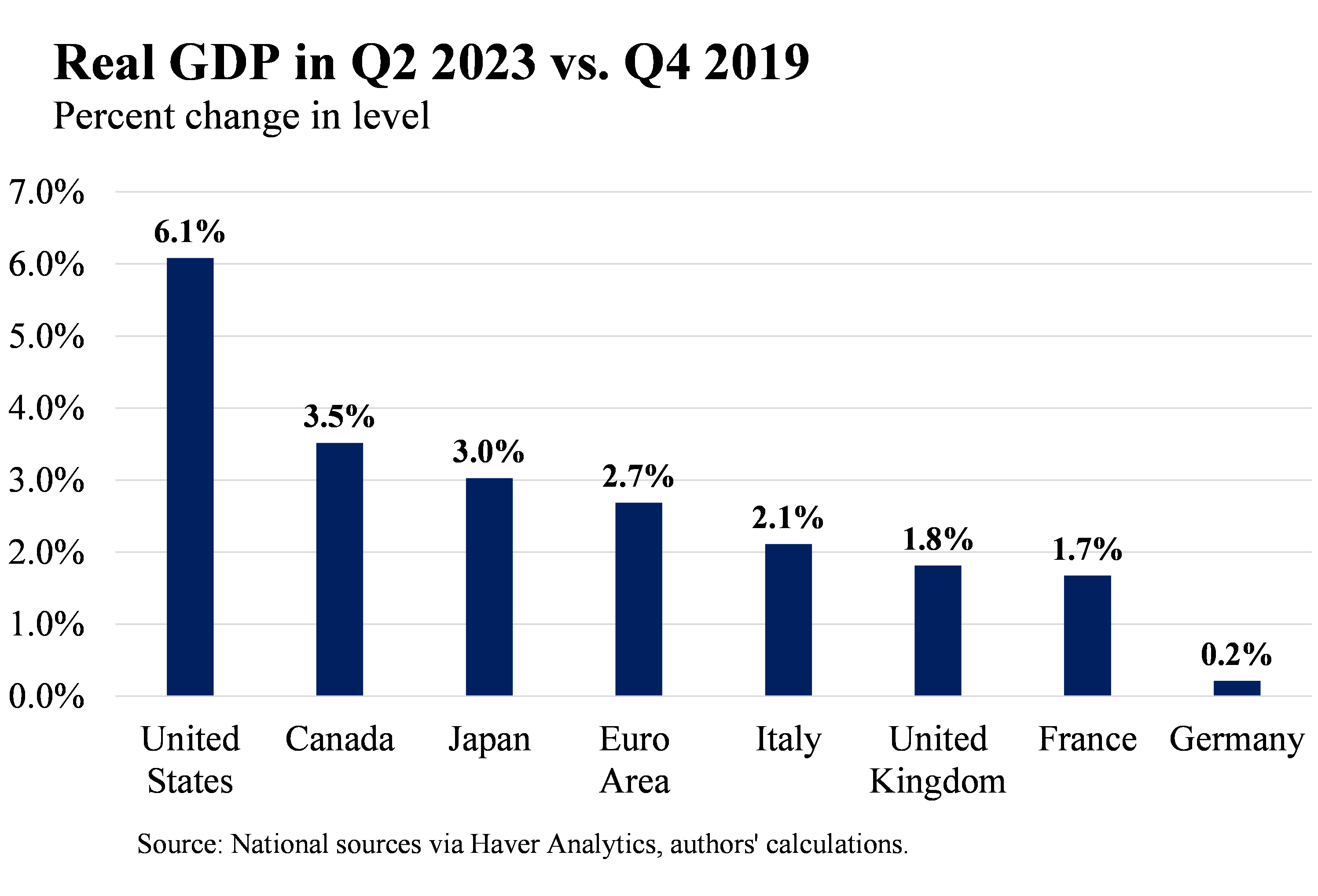

The global recovery has been slow and uneven with considerable divergence across countries. In most advanced economies, real GDP has risen above pre-pandemic levels. U.S. real GDP surpassed its pre-pandemic level in the first quarter of 2021 and is now 6.1 percent higher than in Q4 2019.

Partly due to the divergent shocks noted above, real GDP recovery has been quicker in energy- exporting countries (U.S. and Canada) than in energy-importing countries (remaining countries in the figure).

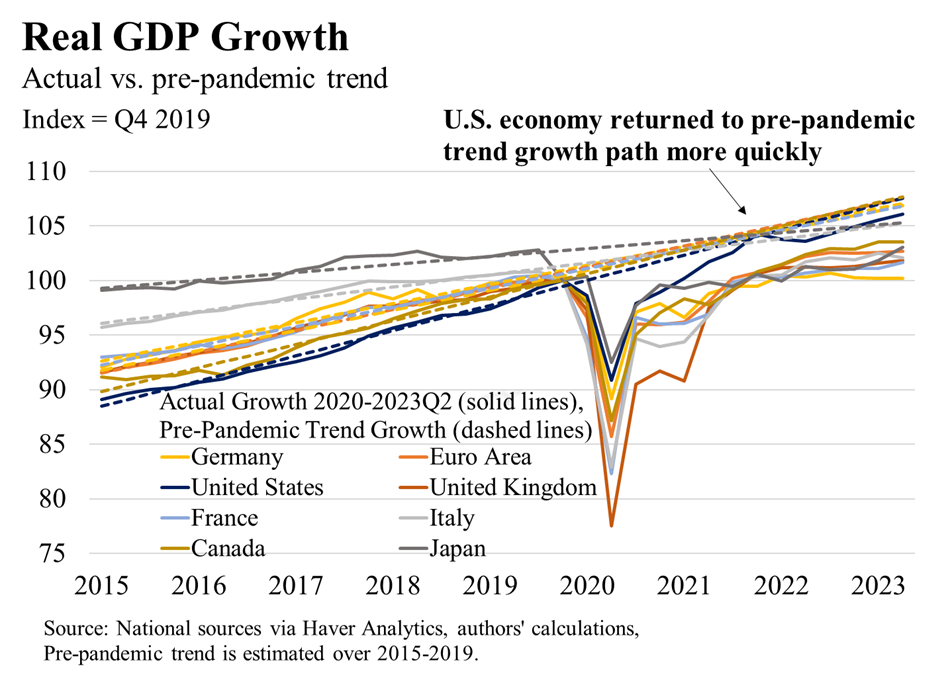

Even today, most advanced economies are below the trend growth path that they were on before the pandemic – except the United States, which is on track this year to return to reach the level that would have been predicted by the pre-pandemic trend. None of the large advanced economies in our sample have reached the level of GDP they would have today if pre-pandemic trends persisted. But given its quicker return to trend growth, the United States is the closest, real output is only 1.4% lower than if pre-pandemic trends persisted.

LABOR MARKETS REMAIN RESILIENT

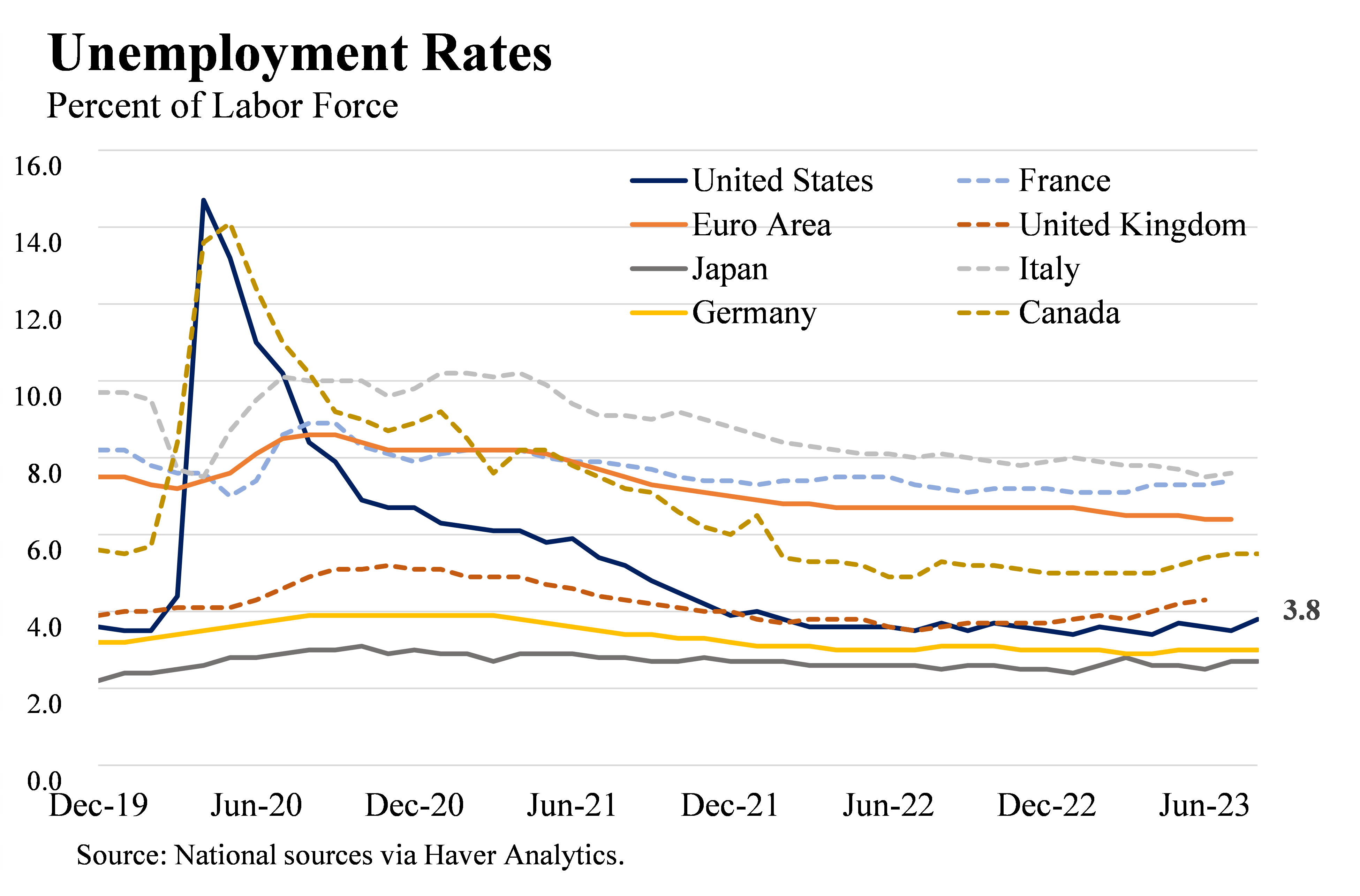

Differences in national labor policies can make unemployment rate comparisons across economics especially difficult. But even so, COVID-era unemployment statistics show significant divergence across the G7. The United States and Canada experienced high spikes in their unemployment rates in April and May of 2020 and supported workers through supplemental unemployment insurance, while several European economies with workshare schemes saw declines in their unemployment rates.

However, after the COVID shock the U.S. unemployment rate rapidly improved and has been consistently below 4 percent since January 2022. Amid the most rapid monetary tightening cycle since the 1980s and an increasing labor force participation rate, the jobs market in the United States remains strong with a current unemployment rate of 3.8 percent.

Although many other advanced economies have higher unemployment rates than the United States, they are also showing resilience. In August, the euro area unemployment rate returned to its record low of 6.4%.

INFLATION IS GRADUALLY NEARING TARGET

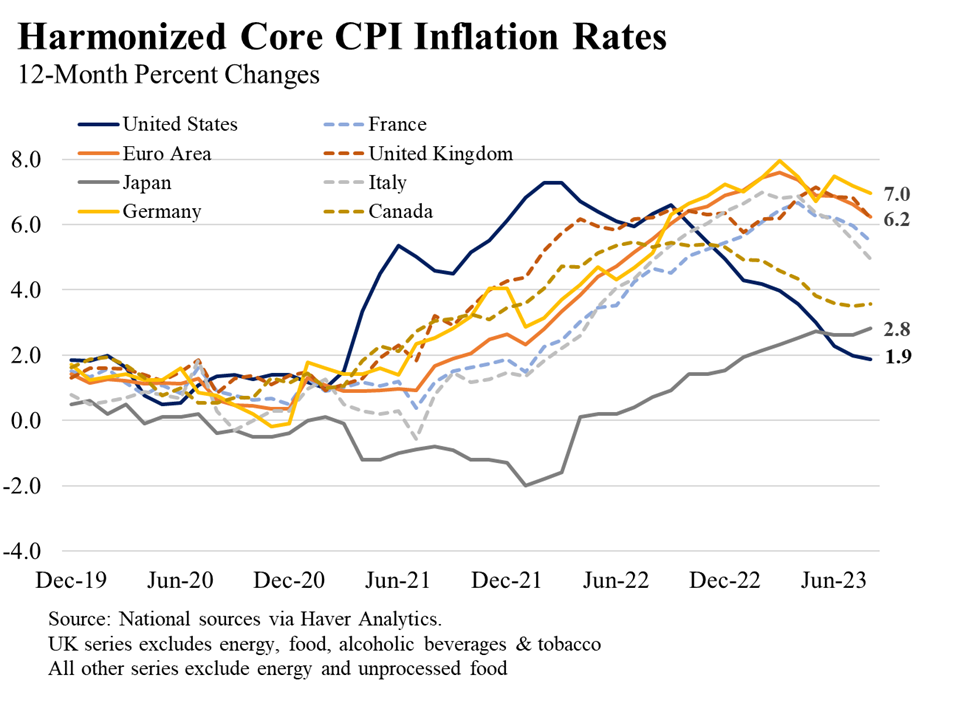

U.S. core CPI inflation (excluding food and energy) has declined significantly over the last 12 months. Cross-country comparisons, however, are not simple because countries have different standards as to what is included in their inflation consumption baskets—most notably regarding owners’ equivalent rent (OER, or the rental value of housing services received by homeowners). Whereas the United States includes OER in its CPI measure, European inflation statistics do not. Using the core measure of the Harmonized Index of Consumer Prices—excluding food, energy, and OER—enables cross-country comparisons.

Elevated inflation has been a phenomenon among most industrialized nations. Although inflation in the United States rose earlier than in other G7 economies—reflecting the brisk recovery from the pandemic—it also fell sooner and quicker. Indeed, once we exclude owners’ equivalent rent to make U.S. core inflation comparable to other countries, the U.S. harmonized core inflation is now about 2 percent—well below many other large advanced economies.[1] Some of the differential relative to European economies is due to Russia’s invasion of Ukraine, which raised food and energy prices substantially with some passing through to core inflation. Even despite this challenge, these economies have shown some signs of disinflation recently—welcome trends for their near- and medium-run outlooks.

CONCLUSION: IMPROVING NEAR-TERM OUTLOOK

Stronger-than-expected U.S. growth continues to drive surprises to the upside in global growth in 2023, and the IMF notes that the likelihood of a hard landing has receded and the downside risks from last spring have moderated. While important risks for the U.S. economy remain, the progress we have made underscores the value of a swift and growth-oriented policy response while making important investments in our economy’s long-run productive capacity.

[1] Including OER raises the U.S. core inflation rate to 4.1 percent in September 2023, but the broad international comparison conclusions hold when we use individual country-preferred measures.

![Saturday News: “Trump’s latest tariff TACO probably won’t make your life more affordable”; “The Epstein Email Cache: 2,300 Messages, Many of Which Mention Trump”; “[MTG] questions if Trump is still the ‘America First’ president”; “Jim Ryan tells all: ‘What did the Governor know, when did he know it?’”](https://bluevirginia.us/wp-content/uploads/2025/11/montage1115.jpg)

![Wednesday News: “The Grand Opening of an American Concentration Camp”; Trump Threatens to Arrest Mamdani; “Poorest Americans Would Be Hurt By Trump’s Big Bill”; [VA] GOP nominees share stage, but not unity”; “Hoos your daddy, Virginia?” (Not Youngkin)](https://bluevirginia.us/wp-content/uploads/2025/07/montage0702.jpg)

![Thursday News: “Europe draws red line on Greenland after a year of trying to pacify Trump”; “ICE Agent Kills Woman, DHS Tells Obvious, Insane Lies About It”; “Trump’s DOJ sued Virginia. Our attorney general surrendered”; “Political domino effect hits Alexandria as Sen. Ebbin [to resign] to join Spanberger administration”](https://bluevirginia.us/wp-content/uploads/2026/01/montage010826.jpg)