From Rep. Don Beyer (D-VA08):

Republicans Advance Bill That Hikes Taxes For Working People And Cuts Taxes For Billionaires

May 14, 2025 (Washington, D.C.) – Rep. Don Beyer (D-VA), who serves on the House Committee on Ways and Means and as the Senior Democrat on Congress’ Joint Economic Committee, voted against legislation offered by Republicans on the Ways and Means Committee that would cut taxes for the wealthy while doing little for regular people, and even raising taxes for many working Americans.

Beyer said:

“Democrats relentlessly fought for over 17 hours to protect Americans’ health care, lower costs, and support working people, while Republicans just as relentlessly fought to protect the wealthy.

“At every turn, Republicans voted down amendments designed to prevent the majority of benefits of their tax bill from flowing to rich people. They defeated amendments to close the carried interest loophole, and to resume pre-Trump tax rates for the highest income bracket. They voted to protect an expansion of the estate tax, a tax cut that only benefits a small number of estates worth over $25 million, at a cost of hundreds of billions of dollars. Republicans even rejected an amendment that would simply have blocked their tax cuts from benefitting billionaires.

“At the same time, Republicans rejected Democratic amendments to protect Americans’ health care. As new, nonpartisan estimates show nearly 14 millions at risk of losing coverage from this legislation, Republicans voted against amendments to prevent these life-threatening cuts. They also rejected our amendments to stop Trump’s trade war and stop attacks on American energy, effectively voting to sustain higher prices, destroy the American clean energy industry, and raise everyone’s electric bill in the process.

“The biggest surprise of the markup came when JCT distribution tables, delayed by Republicans’ massive last-minute changes to the bill, revealed that tens of millions of working Americans will actually see a tax increase the year Trump leaves office under Republicans’ bill. This is largely because they made provisions like addressing taxes on tips and overtime pay temporary, as opposed to the cuts for the richest 1%, which they made permanent. The unavoidable truth is that Republicans’ core priority with this legislation was to benefit the wealthy at the expense of everyone else, and that is exactly what their bill does.”

Beyer spoke in opposition to the bill at the outset of the markup, and offered amendments to bar people who earn over $100 million per year from benefitting from Republican tax cuts, and to close the carried interest loophole, both of which were defeated with all Republicans voting against. At the end of the 17-hour markup, Republicans advanced the bill on a party-line vote.

Distribution tables produced after the beginning of the marathon markup session by the nonpartisan Joint Committee on Taxation (JCT), Congress’ designated scorekeeper on taxation and spending, showed that the most benefits of Republicans’ tax bill would flow to the wealthiest people in the country, while the lowest quintile of the population would see a tax increase beginning in 2029.

###

Beyer Opening Remarks In Ways & Means Markup Of Republican Tax Cut For The Wealthy

May 13, 2025 (Washington, D.C.) – Congressman Don Beyer (D-VA) today delivered the following remarks [video here] during the opening stages of the House Ways and Means Committee’s markup of Republicans’ legislation to lower taxes for the wealthy while making the largest cut to Medicaid in history:

Top-heavy tax cuts paid for by low-income benefit cuts.

President Trump and the Republican majorities in Congress were narrowly elected – by little more than one percent – with the simple hope from the American people that they would lower costs.

The President himself declared he would “bring prices down on day one.”

Trump and Republicans are now breaking that promise.

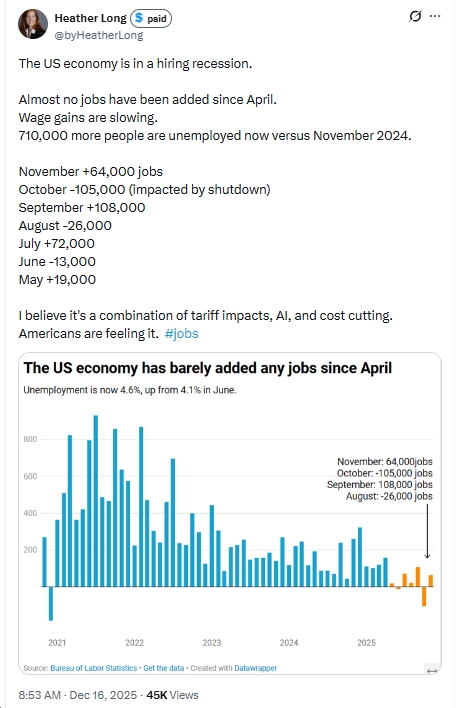

In fact, thanks in part to the unprecedented taxes Trump has imposed on the American people through his nonsensical tariff plan, prices remain high, and consumer inflation expectations have surged.

Americans are seeing the evidence of his broken promise everywhere.

When you buy a cup of coffee, or a used car, or a dozen eggs, we’re paying more now than we did before Trump took office.

On top of that, under Trump’s reckless leadership, our economy took a nosedive in the first quarter of this year, the first time it’s contracted in years.

Many other indicators are flashing red. Economic uncertainty is at a [long] time high, and the conversations around the kitchen table and in small businesses are the same: everybody’s scared.

And that brings us to today.

My Republican friends are hoping this multi trillion-dollar giveaway to the wealthy will somehow dig them out the hole the President has gotten them into.

If history is any guide, more tax breaks for the rich won’t do much, if anything, to put the economy on firmer footing or provide lasting assistance for working- and middle-class Americans.

Their model is the 2017 Tax Cuts and Jobs Act. Trump and the Republicans want to extend it here, but look at it: it failed across the board.

Wages didn’t rise any faster, the economy didn’t grow any faster, and the bill definitely didn’t pay for itself. It just exploded our national debt.

And just like last time, dollar for dollar, the benefits in this bill overwhelmingly skew towards the ultra-wealthy.

It’s nice to have my friends talk about the tax cuts on tips and the tax cuts on overtime, but this is a tiny part of this bill – a distraction from what’s really going on.

They are trying to pull a fast one on the American people, by delivering massive, long-term benefits to millionaires and billionaires, while throwing a few temporary – temporary – tax breaks to working people, timed to help them get through one election cycle.

The folks getting the most help in this legislation are the same folks who don’t bat an eye when prices go up at the grocery store or they buy a new car or they go on vacation, or they’re affected by the tariffs that cost average Americans at least $2,800 a year, according to Yale.

The ultra-wealthy are the very last people that need a boost on their tax returns.

And yet, my Republican colleagues closely attend to their needs in this bill, ensuring that their rates stay low, and estates worth tens of millions of dollars don’t get taxed, and the folks who manage hedge funds keep their special carried interest tax loophole.

Making the legislation even worse is how my Republican friends plan on offsetting its eye-watering price tag.

They want to undermine America’s fastest-growing, most affordable energy sources, and jack up utility bills for working families, and do their friends in Big Oil a big favor in the process.

They want to cut food assistance programs for the poorest Americans, and they’re planning on ripping health insurance away from 14 million Americans, including kids, seniors, and people with disabilities.

I have a constituent, Chris McCauley, with spastic quadriplegia, and he uses a wheelchair.

Medicaid pays for his equipment and support programs during the day.

Without the help of his dedicated caregivers, and the support Medicaid provides his mother, she wouldn’t have been able to work full-time and support her family as a single mom for the past 20 years.

These are the kinds of families that this legislation will harm.

All to help give their rich donors a tax break they don’t need, and that won’t change their lives at all.

Trump and the Republicans have shown what their priorities are.

At every turn, they choose to the help the rich, often by taking money directly out of the pockets of working Americans.

This bill will be a disaster for the American people, and will further divide our society between the thoughtlessly-comfortable and the yearning discouraged.

Top-heavy tax cuts paid for by low-income benefit cuts.

I urge all of my colleagues to vote no.

********************

UPDATE 9:08 am – Also, see below for Rep. Jennifer McClellan (D-VA04) as she “Slams Republicans’ Efforts to Gut Medicaid and the Affordable Care Act.”

![Thursday News: “Europe draws red line on Greenland after a year of trying to pacify Trump”; “ICE Agent Kills Woman, DHS Tells Obvious, Insane Lies About It”; “Trump’s DOJ sued Virginia. Our attorney general surrendered”; “Political domino effect hits Alexandria as Sen. Ebbin [to resign] to join Spanberger administration”](https://bluevirginia.us/wp-content/uploads/2026/01/montage010826.jpg)