I posted the other day about how the CEO of EQT, the main company behind the Mountain Valley Pipeline (MVP) fracked-gas boondoggle, had no serious answers to serious questions, only blather, misdirection and gaslighting. Of course, if you had to defend a horrible project like the MVP, what could you possible say?

Also, perhaps we should give EQT’s new CEO Toby Rice a bit of a break? OK, maybe not – haha. But yeah, Rice is probably pretty steamed (get it?) these days about his company’s stock price, which continues to fall, closing at $11.35/share today, down from $21.45/share on May 21 and $28.02/share last August 23. How low can EQT stock go? Who knows!

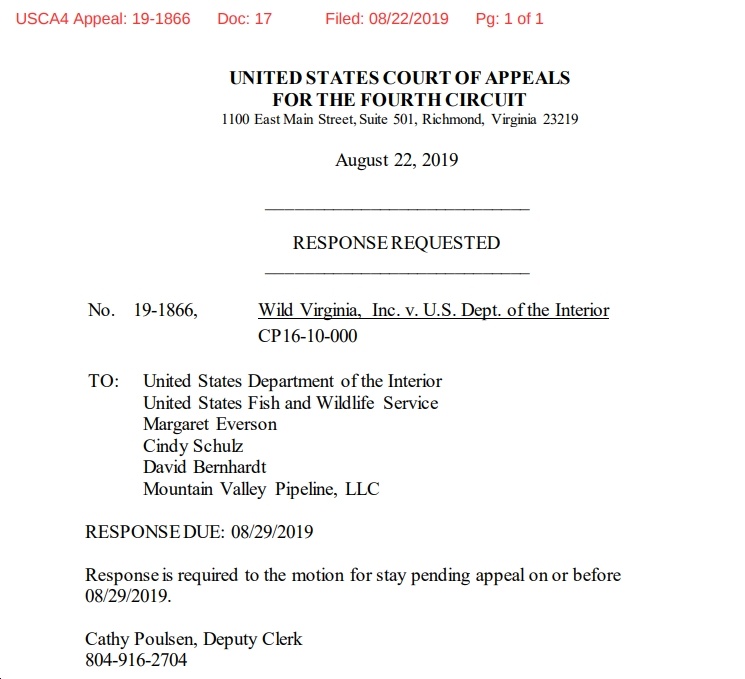

Now, the U.S. Court of Appeals for the Fourth Circuit just told MVP, LLC that it has seven days (by 8/29) to convince the Fourth Circuit Court of Appeals not to shoot them down on a motion for a stay, filed yesterday, by a coalition of environmental groups led by Sierra Club, CCAN and Defenders of Wildlife.

Meanwhile, check out this article about EQT from late July, which states:

…based on the US Energy Information Administration’s Short-Term Energy Outlook, natural gas prices are expected to fall 8.8% in the second half. Oil prices might also trend downward for the rest of this year. Unless the company’s current management makes a turnaround in its business, the remaining months of 2019 could be bleak.

Let’s repeat that last line for emphasis: “Unless the company’s current management makes a turnaround in its business, the remaining months of 2019 could be bleak.” Which, of course, is an outcome that would be well-deserved for this absurd, environmentally destructive, economically nonsensical project-from-hell.

![Sunday News: “Trump Is Briefed on Options for Striking Iran as Protests Continue”; “Trump and Vance Are Fanning the Flames. Again”; “Shooting death of [Renee Good] matters to all of us”; “Fascism or freedom? The choice is yours”](https://bluevirginia.us/wp-content/uploads/2026/01/montage011126.jpg)

![VA DEQ: “pollution from data centers currently makes up a very small but growing percentage of the [NoVA] region’s most harmful air emissions, including CO, NOx and PM2.5”](https://bluevirginia.us/wp-content/uploads/2026/01/noxdatacenters.jpg)