In response to today’s CPI report, DNC National Press Secretary Emilia Rowland released the following statement:

“The Biden-Harris administration hit yet another economic milestone today with inflation levels dropping to their lowest since the pandemic – making the choice this election even starker: After leaving office with the worst jobs record since Herbert Hoover, Trump’s Project 2025 economic agenda would cause an “inflation bomb,” drive us into a recession, raise costs by nearly $4,000 a year for typical middle-class families, and cost 3.2 million American jobs. Vice President Harris has fought tirelessly to help drive inflation down to the low point it reached last month and she’ll keep fighting for working families by taking on price gougers, giving new parents a $6,000 tax credit, and raising the new small business tax deduction to $50,000. Vice President Harris is running to chart a new way forward with lower costs and economic opportunity for all.”

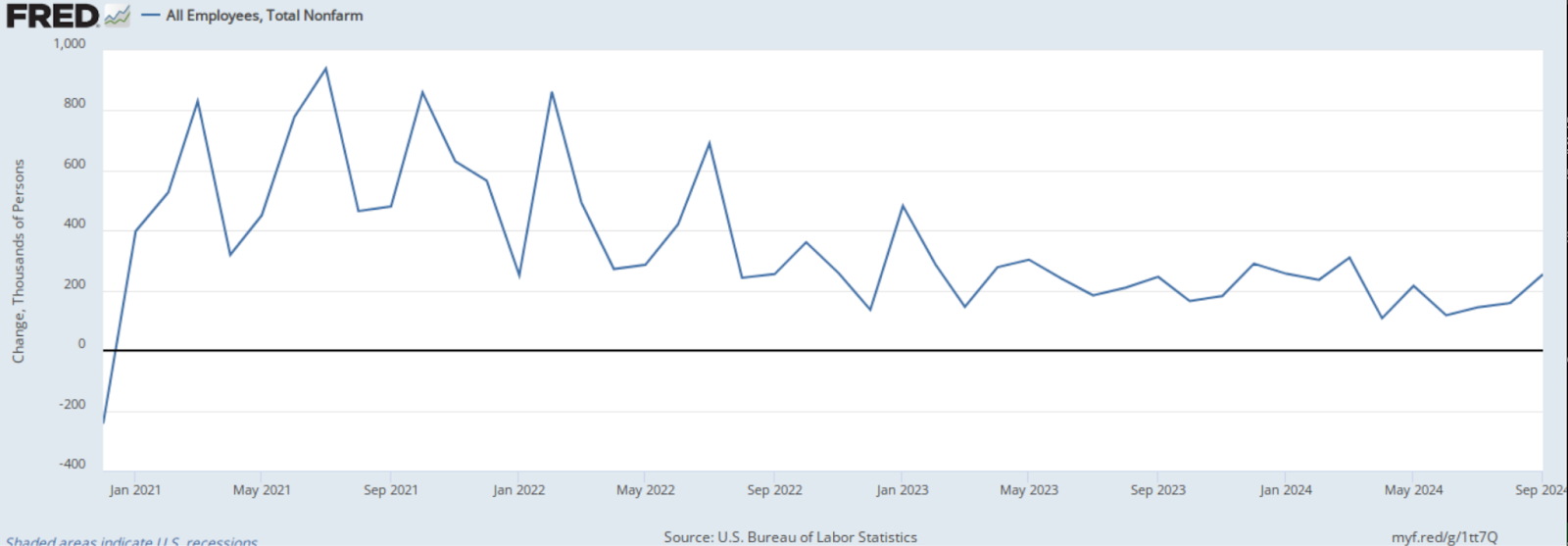

NEW: The latest CPI report shows inflation continues to tick down while we see the 45th consecutive month of job growth under the Biden-Harris administration as unemployment remains low.

Heather Long, Washington Post: “Wages have grown faster than inflation for 17 months now. That’s helping people get ahead now.”

Associated Press: “The improving inflation picture follows a mostly healthy jobs report released last week, which showed that hiring accelerated in September and that the unemployment rate dropped from 4.2% to 4.1%. The government has also reported that the economy expanded at a solid 3% annual rate in the April-June quarter. Growth likely continued at roughly that pace in the just-completed July-September quarter.”

Scripps News: “US inflation rate down to lowest levels since early 2021 in final report before election”

Axios: “Inflation falls to 2.4%, lowest in three years”

New York Times: “Despite all the hand-wringing, the U.S. labor market remains impressively strong.

“Businesses reported adding 254,000 jobs in September, the government reported on Friday. The number far surpassed forecasts and was the strongest monthly gain since March.”

U.S. Bureau of Labor Statistics:

The Harris-Walz administration will chart a New Way Forward by creating an opportunity economy with lower costs, tax cuts for the middle class and small businesses, increased support for caregivers, a permanent expansion of the Child Tax Credit, and historic action giving Americans a shot to compete, succeed, and build generational wealth.

HuffPost: “Democratic presidential nominee Kamala Harris on Tuesday will propose a major new initiative: expanding Medicare to cover the cost of long-term care at home.

“If the proposed legislation is enacted, such a program would represent a substantial boost in federal support for caregiving and, by any measure, one of the largest one-time increases in American history.”

Axios: “The paper, titled ‘A New Way Forward for the Middle Class,’ says that Harris will ‘call on Congress to pass the first-ever federal ban on price gouging.’

“‘The bill will set rules of the road to make clear that big corporations can’t unfairly exploit consumers during times of crisis to run up excessive corporate profits on food and groceries.’”

Washington Post: “More than one-third of mothers who are registered to vote said they worry “a lot” about affording child care, according to a recent KFF poll […] Vice President Kamala Harris has made the ‘care economy’ a cornerstone of her platform, vowing to permanently increase the child tax credit, add a one-time $6,000 credit for newborns and cap child-care costs at 7 percent of a working family’s income.”

Politico: “In her speech, Harris reiterated her support for several other major economic efforts, including a federal ban on corporate price-gouging, expanding tax credits for new small businesses, extending the child tax credit and pledging to build 3 million new homes to address the housing shortage.”

Washington Post: “Harris proposed increasing the tax deduction for start-up businesses from $5,000 to $50,000, and she recapped specifics of her previous policy plans, including $25,000 in down payment assistance for first-time home buyers and a $6,000 tax benefit for parents with newborns.”

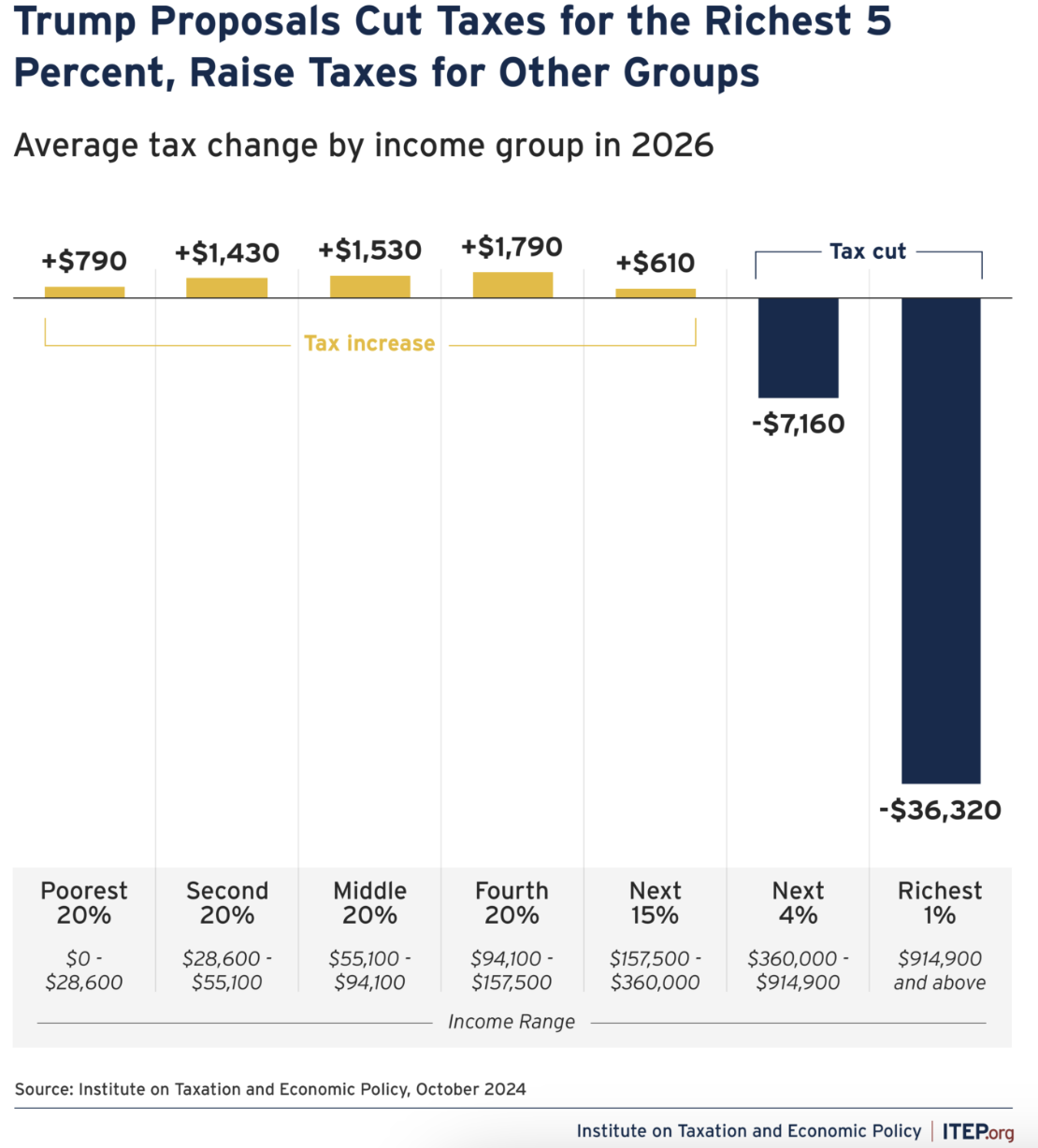

Trump’s Project 2025 economic agenda would cause an “inflation bomb,” driving us into a recession by mid-2025 while raising costs for typical middle-class families by nearly $4,000 a year, and raising taxes on all but the richest 5% of Americans.

Institute on Taxation and Economic Policy: “Former President Donald Trump has proposed a wide variety of tax policy changes. Taken together, these proposals would, on average, lead to a tax cut for the richest 5 percent of Americans and a tax increase for all other income groups.

“If these proposals were in effect in 2026, the richest 1 percent would receive an average tax cut of about $36,300 and the next richest 4 percent would receive an average tax cut of about $7,200. All other groups would see a tax increase with the hike on the middle 20 percent at about $1,500 and the increase on the lowest-income 20 percent of Americans at about $800.”

Center for American Progress: “Former President Trump Proposes an Up to $3,900 Tax Increase for a Typical Family”

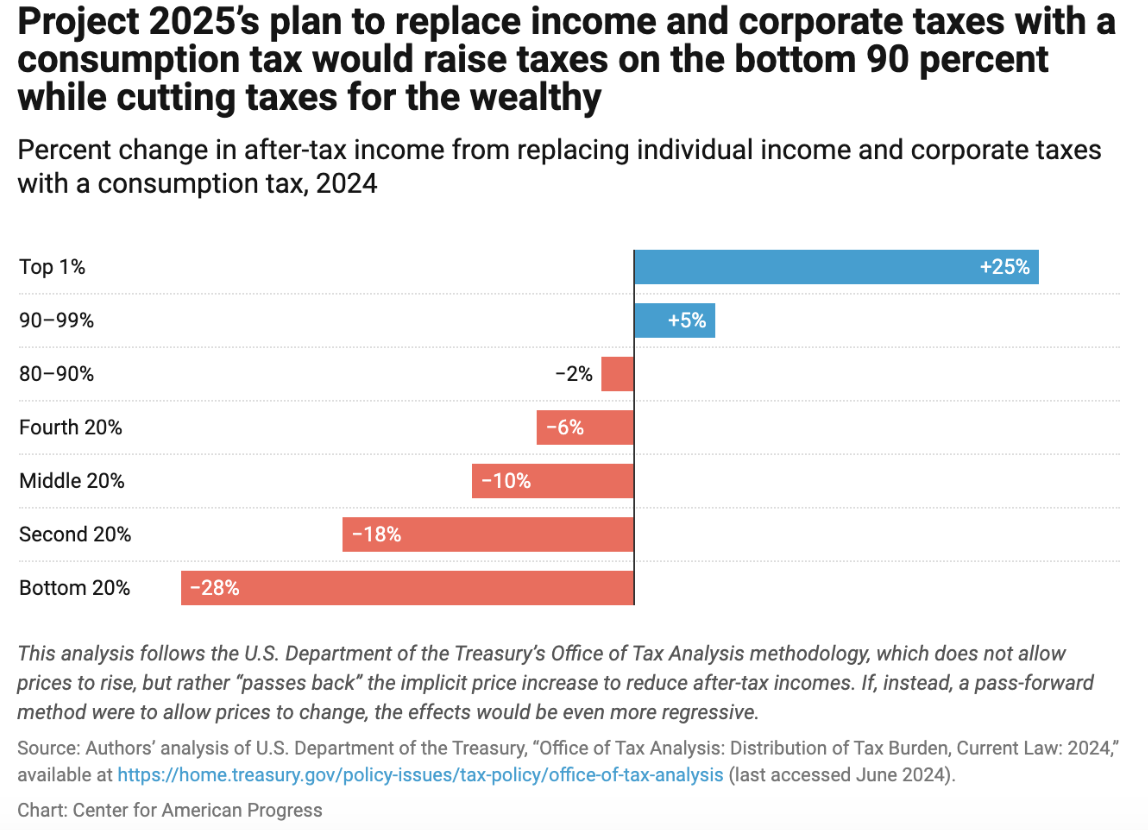

Center for American Progress: “Project 2025’s tax plan includes an ‘intermediate tax reform’ that includes changes to tax brackets and corporate tax cuts that would shift the tax burden toward middle-income households. And the ‘fundamental tax reform’ it proposes would replace all individual income and corporate taxes with consumption taxes.”

Axios: “Trump’s inflation bomb: How his second-term plans could make it worse”

Center for American Progress: “Not only does Project 2025 ensure drug companies are put back in control of access to medication; it calls for a complete repeal of the IRA, which would put an estimated 18.5 million Medicare Part D enrollees at risk of losing out on $7.4 billion in direct savings from the IRA’s drug-related provisions, including its out-of-pocket cost caps.”

Center for American Progress: “In [Project 2025], far-right extremist plans are outlined that raise taxes on low- and middle-income households to finance tax cuts for the wealthy and large corporations. Project 2025’s tax plan includes an ‘intermediate tax reform’ that includes changes to tax brackets and corporate tax cuts that would shift the tax burden toward middle-income households […]

“The shift toward a flat consumption tax while eliminating income taxes would lead to an average $5,900 tax increase for the middle 20 percent of households and an average $2 million tax cut for the top 0.1 percent.”

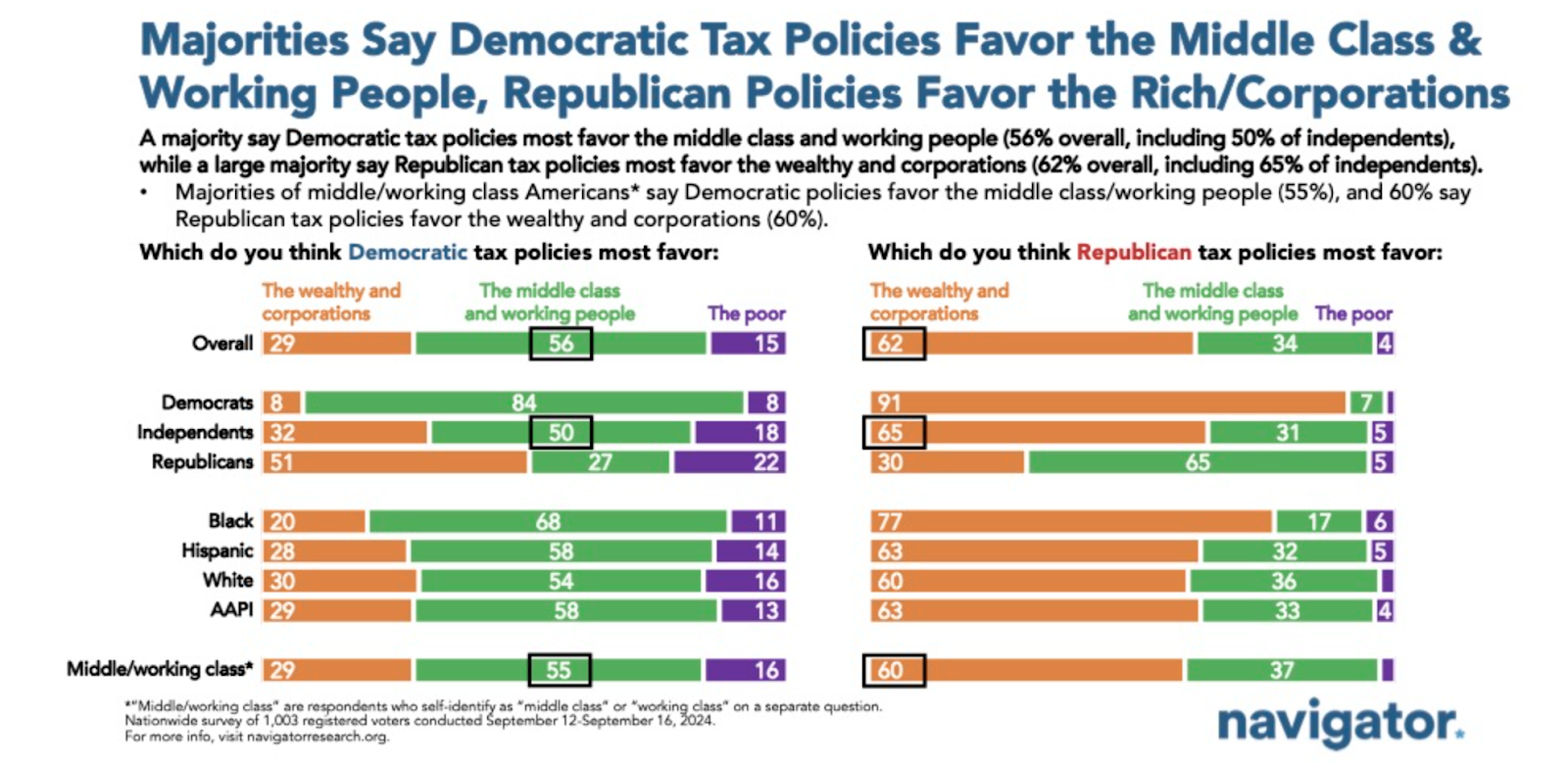

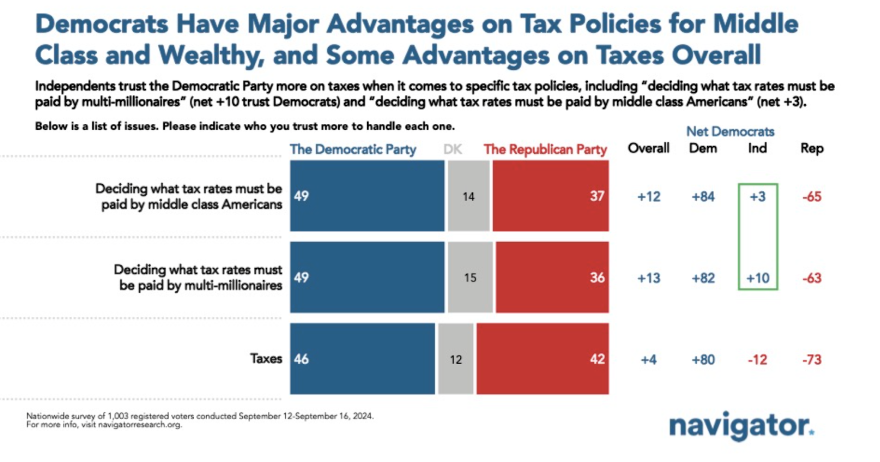

Polls show that Americans believe Democratic policies are fighting for the middle class, while MAGA Republicans policies favor the ultra-wealthy and big corporations.

Navigator: “Three in Five Believe Republican Tax Policies Favor the Wealthy”

“The Democratic Party now holds a narrow advantage on handling taxes in general (net +4; 46 percent trust Democratic Party – 42 percent trust Republican Party) and the cost of living (net +3; 46 percent trust Democratic Party – 43 percent trust Republican Party).”

“A majority of Americans believe Democratic tax policies favor the middle class and working people (net +27; 56 percent favor middle class – 29 percent favor wealthy and corporations), while over three in five believe Republican tax policies most favor the wealthy and corporations.”