by Ivy Main, cross posted from Power for the People VA

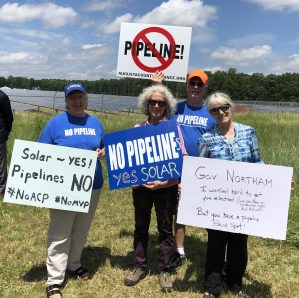

The message from several Virginians was clear at the opening of a new solar farm in Troy, Virginia last month. Protesters want Governor Ralph Northam to speak out against the ACP and the Mountain Valley Pipeline, both under development in Virginia.

Utility giant Dominion Energy and gas turbine maker General Electric reportedly agree on a startling fact: there is no market for new baseload gas plants.

As recently as two years ago, Dominion’s utility subsidiary in Virginia had as much as 8,000 megawatts (MW) of new combined-cycle gas plants on the drawing board. Combined-cycle plants, designed to run most of the time, have become the dominant source of power generation in Virginia.

This year, new combined-cycle plants are noticeably absent from Dominion Energy Virginia’s Integrated Resource Plan. Proposed instead are a series of smaller, peak-serving combustion turbines. Although the utility is proposing a bunch of them, they will have to compete with increasingly competitive power storage options for regulatory approval.

It’s not just Virginia. According to the Forbes article linked above, Dominion Energy has no plans to build any more combined-cycle plants anywhere, due to competition from wind and solar.

Other utilities are also losing interest in combined-cycle gas plants, as GE has learned to its chagrin. GE is cutting 12,000 jobs in its GE Power unit, says Forbes.

A new study from the Rocky Mountain Institute (RMI) shows why utilities are smart to avoid building new gas plants. RMI says that as early as 2026, cost declines for wind and solar will make it more expensive to operate natural gas infrastructure than to abandon it and replace it with new wind and solar facilities. When that happens, gas plant owners will be left with stranded assets.

Even in today’s market, RMI concludes gas is a risky investment:

RMI examined four case studies of proposed gas plants from utilities across the US. These cases included two combined-cycle gas turbine (CCGT) power plants, planned for high-capacity factor operation, and two combustion turbine power plants, planned for peak-hour operation. These power plants are proposed for a wide variety of regions with different resource availability, resource costs, climate- and weather-driven demand needs, and customer bases.

In all four cases, RMI found clean energy portfolios to be cost-competitive with proposed gas-fired generation, while meeting all required grid services and supporting system-level reliability. In three of the four cases, optimized, region-specific clean energy portfolios cost 8–60 percent less than the proposed gas plant, based on industry-standard cost forecasts and without subsidies. In only one case was the clean energy portfolio’s cost slightly higher than the proposed gas plant. However, further analysis revealed that modest carbon pricing (i.e., < $8/ton) or feasible community-scale solar cost reductions would easily reverse the result. Similarly, two more years of anticipated renewable and storage cost reductions would also eliminate the difference in cost between the clean energy portfolio and the gas plant.

All this is very bad news for the Atlantic Coast Pipeline (ACP). The ACP received approval from the Federal Energy Regulatory Commission (FERC) last year on the strength of supply contracts with the utility subsidiaries of Dominion Energy and Duke Energy, Dominion’s major partner in the pipeline. If these utilities don’t actually need the gas, the whole basis for FERC’s approval of the pipeline collapses.

No wonder Dominion Energy wants to extend its reach into South Carolina. Plans for new nuclear plants in that state recently imploded, potentially leaving a supply gap that new natural gas power plants could fill.

And no wonder Dominion Energy Virginia continues to propose gas combustion turbines and ignore energy storage in spite of the latter’s cost declines. It’s because Dominion is scrambling to save the ACP.

How did Dominion get it so wrong? Recall that Dominion and its partners announced plans for the ACP in early September 2014; the rationale for the pipeline would have relied on industry forecasts from 2013 and before. At that time, the gas industry was giddy about fracked gas displacing coal. While critics (including me) said new baseload gas plants would be giant concrete paperweights before they’d reached the end of their useful life, most utilities were drinking the fracked gas Kool-Aid.

In the intervening years, coal has certainly continued its exit (Donald Trump’s half-baked rescue plans notwithstanding), but solar and wind have become the cheapest source of electricity in the U.S., according to federal statistics. The cost of electricity from utility-scale solar farms has dropped by half since 2013, and by last year Dominion had identified solar as the cheapest source of new electricity in Virginia.

The problem for Dominion Energy is that the ACP is the only big trick it has now, after the failure of its own ambitions for new nuclear. Dominion doubled down on natural gas in 2016 when it paid $4.4 billion for natural gas distribution company Questar, paying a 23% premium on the deal. It can’t back down from gas now. Either it has to spend $6 billion (and rising) on this new pipeline, or admit its entire growth plan was based on a serious mistake.

Abandoning the ACP could make Dominion’s stock price tumble, giving it something else in common with GE. But as the saying goes, if you find yourself in a hole, you should really stop digging. In this case, literally.

Sign up for the Blue Virginia weekly newsletter

Sign up for the Blue Virginia weekly newsletter

![Rep. Eugene Vindman (D-VA07) Has Mostly Been Excellent So Far, But Being One of “35 House Democrats [Who] Joined Republicans Against a Major Climate Policy” Is Not Cool. At All.](https://bluevirginia.us/wp-content/uploads/2025/05/nytcalifornia-238x178.jpg)

![Rep. Eugene Vindman (D-VA07) Has Mostly Been Excellent So Far, But Being One of “35 House Democrats [Who] Joined Republicans Against a Major Climate Policy” Is Not Cool. At All.](https://bluevirginia.us/wp-content/uploads/2025/05/nytcalifornia-100x75.jpg)