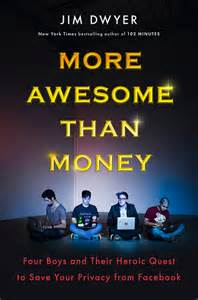

I just finished reading the fascinating new book More Awesome Than Money: Four Boys and Their Heroic Quest to Save Your Privacy from Facebook by Pulitzer Prize winner and New York Times reporter Jim Dwyer. The Wall Street Journal describes the book as the efforts of “four idealists frustrated with Facebook’s control over our personal data…to create an alternative,” and why they didn’t ultimately succeed. Other than being a fascinating story, with drama and even tragedy (specifically, the suicide of brilliant, charismatic co-founder Ilya Zhitomirskiy), the book covers important issues facing all of us in the age of social media, the “cloud,” etc.: privacy, the digital “Panopticon,” the profit motive vs. creating something socially beneficial, how promising technologies do or don’t end up getting funding to move forward, implications for society, even human identity itself. I make absolutely no pretensions to being an expert on any of this, just someone interested in the subject. So, I asked my friend Yosem Companys — who teaches high-technology entrepreneurship at Stanford University, runs social media for Stanford’s Program on Liberation Technology, and previously worked as consiglieri and CEO of Diaspora (with a crucial role to play in “More Awesome than Money”) – whether he would be willing to answer a few questions. He graciously agreed. Here’s the interview, edited for conciseness and clarity. Note: I’ve decided, due to the interview’s length (16 questions and answers), to break it up into four parts. The first four questions and answers are available here, the second part (questions #5-#8) is here, and the third part (#9-#12) is here. Now, here are questions #13-#16.

I just finished reading the fascinating new book More Awesome Than Money: Four Boys and Their Heroic Quest to Save Your Privacy from Facebook by Pulitzer Prize winner and New York Times reporter Jim Dwyer. The Wall Street Journal describes the book as the efforts of “four idealists frustrated with Facebook’s control over our personal data…to create an alternative,” and why they didn’t ultimately succeed. Other than being a fascinating story, with drama and even tragedy (specifically, the suicide of brilliant, charismatic co-founder Ilya Zhitomirskiy), the book covers important issues facing all of us in the age of social media, the “cloud,” etc.: privacy, the digital “Panopticon,” the profit motive vs. creating something socially beneficial, how promising technologies do or don’t end up getting funding to move forward, implications for society, even human identity itself. I make absolutely no pretensions to being an expert on any of this, just someone interested in the subject. So, I asked my friend Yosem Companys — who teaches high-technology entrepreneurship at Stanford University, runs social media for Stanford’s Program on Liberation Technology, and previously worked as consiglieri and CEO of Diaspora (with a crucial role to play in “More Awesome than Money”) – whether he would be willing to answer a few questions. He graciously agreed. Here’s the interview, edited for conciseness and clarity. Note: I’ve decided, due to the interview’s length (16 questions and answers), to break it up into four parts. The first four questions and answers are available here, the second part (questions #5-#8) is here, and the third part (#9-#12) is here. Now, here are questions #13-#16.

Question #13: Do you agree or disagree with the Salon article which suggests that social-networking sites like Facebook are reinventing human identity?

Yosem Companys: I found the premise of that article laughable, because Facebook has not reinvented anything in terms of human identity. Human behavior remains the same. All that has changed is that design values are nudging and shaping behavior in a different direction; that is, in the direction that Facebook’s engineers want. (Notice I did not even mention Mark Zuckerberg because, at this point in time, he is quite detached from design decisions, though the imprint left by his early software remains.) But the history of corporations shows that the dominant ones do not remain dominant forever (if I remember correctly, something like 90% of the largest US corporations from the 1890s don’t even exist today), and the very fact that a company like Facebook requires that you express your identity in one particular way creates an opportunity for a startup to disrupt it simply by allowing you to express yourself in a different way. Facebook then has the choice of incorporating the functionality (which is what happened when Facebook copied Diaspora’s gender field), buying the startup and allowing it to continue to offer the functionality independently, or killing the startup altogether and leaving the space open for yet another one to challenge it later.

The bigger problem I see is that we are unlikely to see challenges to Facebook’s identity model unless we start training programmers differently by making them more aware of the power they hold to influence user behavior and by encouraging them to do so in ways that improve the lives of users. In other words, programmers need to be taught to listen to users, to be sensitive to their needs, and to design more of the things that users want in the ways that they want. If we did so, we would probably design sites with privacy and security in mind from the very beginning, something that does not happen now because the focus is on cost and practicality rather than on user needs.

Question #14: What does the Diaspora experience tell us, if anything, about people’s need to make a profit vs. the desire to create something socially beneficial.

Question #14: What does the Diaspora experience tell us, if anything, about people’s need to make a profit vs. the desire to create something socially beneficial.

Yosem Companys: I liked the Salon piece you sent me on this, as it is trying to grapple with many of these issues. For me, the key issue here is legal. I’m not sure how you could ever do better than the for-profit model for innovation if your goal is to make a technology widely adopted. For-profit firms are able to raise huge sums of money because they have the potential of making huge sums of money. And the way you fuel adoption is via marketing and advertising, as well as through further investments into enhancing the firm’s technical and organizational capabilities, all of which require huge sums of money. That fact that Ello and Diaspora grew big, quickly, after just a simple mention in the tech press and the New York Times, respectively, while other firms that experts agree had better technologies did not do so, is a testament to the power of marketing and advertising in technology commercialization.

Remember: Building a startup is not so much about a superior technology but about execution — about building human systems. A conventional technology with great execution at building human systems will always trump a revolutionary one with poor execution.

Question #15 : Why not set up a non-profit like Mozilla and Wikipedia?

Yosem Companys: I don’t know all the legal details of how Mozilla and Wikipedia are set up, as there are a number of ways that non-profit organizations can set up for-profit arms. But, generally speaking, non-profits, due to their limited ability to raise investment funds and their provision of having to donate all their money to charity at the end of the year, are ineffective growth vehicles. And they are much more subject to regulatory oversight, which can be onerous, particularly when they have federal tax-exempt status, something that is difficult and time-consuming to secure. Other than that, non-profits and for-profits are almost identical in that they are controlled by their founders and owners, respectively, and their boards.

Question #16: What, if any, are the downsides of the for-profit model?

Yosem Companys: One downside of both the for-profit and non-profit model, of course, is that founders and shareholders, as owners of these firms, disproportionately benefit over workers, fueling inequality. And stock options are a poor solution because of the small amount of profit sharing these mechanisms provide to employees. One solution could be the use of employee- or user-owned cooperatives, something that has not really been tried much in Silicon Valley. In such a model, you could still have a for-profit firm, but you would allow employees and users to own, say, half the firm and sell the other half to investors. Investors would still have an incentive to invest and, because employees often understand their business better than shareholders, employees could then theoretically provide better insights into how the firm should be run effectively and profitably, thereby creating more profit opportunities for shareholders and reducing inequality by allowing employees to keep a larger cut of the profits of the firm.

Another problem is that, as economists have long shown, there are technologies that don’t make a profit and, when such market failures occur, you need the government to get involved. But the American people generally have an aversion to government intervention, and the existence of Silicon Valley has created the false perception that it was solely built by entrepreneurs, when academia and government agencies like the US Department of Defense basically developed the Internet, as the historical record shows. The history of technology, in fact, has demonstrated that the role of government and academia in the development of new technologies has been crucial in many of the world’s most advanced economies. This is shown by the examples of post-WWII Japanese innovation and the industrialization of 19th century Germany, both of which occurred via national industrial policy. The role of Wall Street financiers in the early days (and later venture capitalists, who get most of their money from mutual funds) is also often underestimated. Yet, ironically, many spend all their time criticizing government and bankers, neglecting the important role these actors played – and continue to play – in driving invention and subsequent innovation.

There is an extensive literature that suggests the appropriate role for the US government is at funding invention, whereas the appropriate role for the private sector is at funding innovation (i.e., inventions with a business model). The debate in this literature has focused on the “valley of death,” that is, the transition from invention to innovation, where investors don’t fund innovations because the risk is too high, and where government doesn’t get involved because it doesn’t fund commercial ventures. Thus, the role of the private-public partnership for successful technology commercialization is key. For example, some studies (for an early one, see here) show that government-funded firms subsequently tend to raise more venture capital and perform better because of the signaling effect that it sends to prospective investors that such firms have inventions that have been vetted and certified as more promising than others. One notable example of that is Google, but there are many others.

In short, what makes for a great technology does not always correspond with what makes for a great business, and many of the failures of supposedly hot Silicon Valley startups are a testament to that.

![Thursday News: “Europe draws red line on Greenland after a year of trying to pacify Trump”; “ICE Agent Kills Woman, DHS Tells Obvious, Insane Lies About It”; “Trump’s DOJ sued Virginia. Our attorney general surrendered”; “Political domino effect hits Alexandria as Sen. Ebbin [to resign] to join Spanberger administration”](https://bluevirginia.us/wp-content/uploads/2026/01/montage010826.jpg)

![Sunday News: “Trump Is Briefed on Options for Striking Iran as Protests Continue”; “Trump and Vance Are Fanning the Flames. Again”; “Shooting death of [Renee Good] matters to all of us”; “Fascism or freedom? The choice is yours”](https://bluevirginia.us/wp-content/uploads/2026/01/montage011126.jpg)

![New Year’s Day 2026 News: Full Video of Jack Smith Testimony – “The attack that happened at the Capitol…does not happen without [Trump]”; Trump/RFK Jr Make Measles Great Again; Right-Wing YouTuber Nick Shirley Definitely Not a Real Journalist; Musk Did Enormous Damage in 2025](https://bluevirginia.us/wp-content/uploads/2026/01/montage010126.jpg)