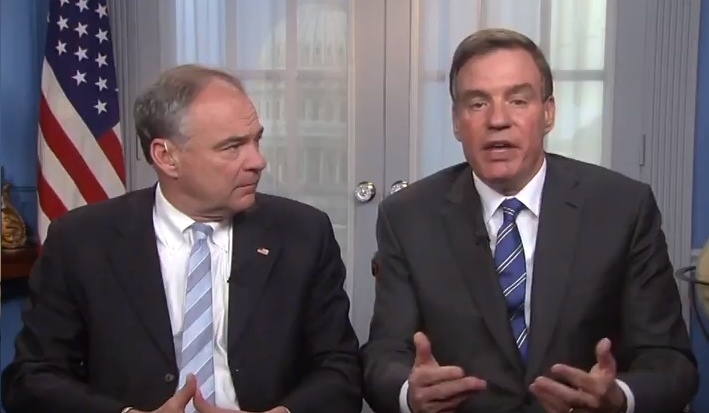

Sen. Mark Warner covers some, not nearly all of the flaws in the GOP tax bill monstrosity. Kill this thing – dead.

Mr. President, I come to the floor today to join other colleagues from both sides of the aisle to talk about this tax debate. You know, we don’t do tax reform nearly enough here in the United States. It seems we take it on about every 35 years whether we need to or not but if there’s one lesson that we’ve learned from previously tax reform efforts is that while they can do a lot of good, they can also do a lot of harm.

And I have to start by expressing my extraordinarily deep frustration with the process that we’ve gone through. Today we are considering a bill that was drafted in secret, designed with more gimmicks and loopholes that I’ve ever seen, and is being rushed through in a process without impact from all of us on this side of the aisle and without even appropriate impact of its true financial analysis. In many ways, to quote the president, what got us here is the worst of Washington. If you want to see swamp 101, look at the process of this tax bill.

A 300-page tax bill that was released on the eve of a holiday weekend, only days before it was marked-up in committee. And over a four-day markup, two significant rewrites of this bill were presented. One consisted of over 100 pages of changes and a second was released a mere 30 minutes before members were asked to vote on literally its myriad of provisions. Now, less than two weeks later, we’re considering that bill or a variation of it on the Senate floor.

We’re voting either to proceed on the bill later today and then maybe on amendments tomorrow before we have any analysis from J.C.T. [Joint Committee on Taxation] and we know that near the end of the debate on the floor, another bill will magically appear from the majority leader’s office without any time for those of us who want to do tax reform to have a chance to genuinely review or analyze it’s provisions. It makes this process, I believe, enormously dishonest. I know my friend from Delaware has just come on. I’ll speak quickly, because I know he’ll raise some of these same concerns.

One of the things that I’ve been most involved with since I’ve been here in the United States Senate is trying to grapple with our nation’s overwhelming debt. We’re a country that’s run up close to $20 trillion of debt. And both sides — both sides — have been party to that over the last 70 years. But what I have heard from colleagues on both sides of the aisle is that when you’re in that deep of a hole, you ought to stop digging. And that we need to make sure that if we’re going to do tax reform, we do it in a fiscally responsible way. This legislation is the absolute opposite of any kind of fiscal responsibility under anybody’s guide book.

It starts with a $1.5 trillion acknowledgment that that money will somehow magically appear through magical growth. But, when you peel that away a little bit, it is bad enough that it’s not really $1 .5 trillion in additional debt that we’re adding. The real number is $2.2 trillion. Let me tell you why. Off of the $1.5 trillion additional debt that’s added, that alone will generate more than $230 billion of additional interest payments over the next decade. Raising the cost of the bill from $1.5 trillion to roughly $1.7 trillion.

And then in an effort that really takes the cake in a place where both – again, both sides have been known to use gimmicks, this legislation includes 37 different expiring provisions, provisions that are popular, provisions that a number of my colleagues have said give middle-class tax relief. Well, the interesting thing is, all of these provisions are due to expire five to six years within the ten-year window.

And rather than acknowledging the true cost of the bill, what people have said is, we know what we’re going to create. We’re going to create a whole new series of fiscal cliffs in the neighborhood of $500 billion that the expectation will be that they’ll become so popular that Congress will go ahead and have to extend these provisions again without paying for them.

In terms of gimmicks, don’t take my word for it. You only need to listen to the words of the President’s own OMB [Office of Management and Budget] Director, Mick Mulvaney who recently acknowledged that quote the tax bill had a lot of gimmicks to it. Well, you add that $500 billion to the $230 billion of additional interest, to the $1.35 trillion that you start with, and what we are talking about today is $2.2 trillion addition to our debt. For all my friends who for years have stood with me on the floor of the Senate and spoken out against adding this additional burden to our kids and grandkids, I hope they’ll talk a moment and rethink their support for this legislation.

Now, some have said well how will this get paid for? I believe there might be some dynamic growth, there might be some addition from smart tax reform that would add to the growth of our economy. But nothing near what this bill assumes. In fact, it’s even worse than that in certain ways. Not only will this add over $2 trillion to our debt and deficit, but we’ve even had the audacity of the Secretary of the Treasury, Secretary Mnuchin, who said this bill is going to be so good for our economy that it’s going to decrease our debt by $1 trillion. Yet there is no responsible budget projection of any economist from left to right that makes any kind of assumptions that would make that kind of prediction true at all. And if we go back and look in recent American history, when you pay for tax cuts with borrowed money, you end up with a pretty bad situation.

Many of my friends on the other side of the aisle like to cite Ronald Reagan. I think President Reagan was a great president in many ways. President Reagan’s 1981 tax cut did provide a short-term stimulus but then that stimulus ran out and our debt and deficits blew up, grew dramatically and President Reagan himself had to raise taxes in 1982 and 1984. Likewise again, President Bush in 2001 inheriting a surplus, promised again that the magic of tax cuts will grow our economy. Instead we ended up with very little job growth and a debt and deficit now that is rapidly approaching the full size of our economy.

And if we went out and looked at scoring of the effects of this kind of tax cut, we’ve seen the Tax Policy Center that did a dynamic score saying well how could build this growth that comes from a tax cut. They said again this bill costs at least $1.5 trillion. The Penn-Wharton budget model, again an organization well respected by both sides of the aisle, did a dynamic score on this legislation as well. Again they’re saying minimum costs of $1.5 trillion. And Congress’ official scorekeeper, the group that we look to for outside advice, the Joint Committee on Taxation, we are rushing this bill through so quickly that we’ve not even allowed our official scorekeeper to come up with a score. This is not the way to do a once-in-a-generation tax reform process.

The truth is when you do a tax cut with borrowed money in periods similar to where we are right now, relatively full employment, there is no historical precedent at all that you’ll see any kind of economic growth. Again, don’t take my word for it. Alan Greenspan, the respected Fed chair, pointed this out just within the last two weeks. That tax cuts paid for with borrowed money do not provide the kind of growth that this tax reform projects.

Now I could go through a whole litany of other concerns with this legislation. I for one believe we do need to do international tax reform. I for one believe we need a corporate tax rate that’s more competitive. I for one believe we need repatriation and to bring back tax profits that have gone abroad. But we’ve seen analysis recently that shows that this legislation may actually increase the amount of American jobs that are pushed overseas, for example, because of the averaging of tax rates in their so-called territorial system where a company could build that factory in a relatively high tax state, move their intellectual property to a tax heaven like the Cayman Islands, average out the tax bill combined and end up paying the country, our country, nothing and at the same time continuing to see job loss around our country.

There are a group of us, close to 17 of us, and many of my colleagues on the floor today, that came together yesterday, that said to our Republican colleagues time out for a few minutes. We will work with you to do a responsible tax reform effort. We share many of the same goals. But unfortunately, the process that we’re going through here today to reach some kind of arbitrary Christmas present for the president is not the way we ought to be doing responsible tax reform.

I hope my colleagues will reconsider. I hope they’ll take the offer of the 17 of us who said we’ll look at corporate tax reform. We’ll look at lower rates. We’ll look at repatriation. We’ll look at ways to make businesses more competitive. And join with us and do this in a way that we can all be proud of.

If we’re only going to do tax reform once every 30 or 35 years, we sure as heck owe the American people a product that we can all be proud of, not a product that’s rushed through with one party only that at the end of the day will leave our kids and grandkids paying the bill for decades to come.

With that, Mr. President, I yield the floor.

![Thursday News: “Europe draws red line on Greenland after a year of trying to pacify Trump”; “ICE Agent Kills Woman, DHS Tells Obvious, Insane Lies About It”; “Trump’s DOJ sued Virginia. Our attorney general surrendered”; “Political domino effect hits Alexandria as Sen. Ebbin [to resign] to join Spanberger administration”](https://bluevirginia.us/wp-content/uploads/2026/01/montage010826.jpg)