Yesterday, Pew released a new analysis of Virginia’s small-dollar loan marketplace, which, they write, “shows the Commonwealth’s small-loan statutes have unusually weak consumer protections, compared with most other laws around the nation.” Sadly not surprising. Pew also finds:

- Virginia laws enable lenders to charge Virginians up to three times as much as customers in other states for the same type of loans.

- Virginia is one of only 11 states with no cap on interest rates for installment loans over $2,500.

- Virginia has no interest rate limit for lines of credit and is one of only six states where payday lenders use such an unrestricted line-of-credit statute.

- Many lenders operate stores and online in Virginia without licenses, issuing lines of credit similar to credit cards, but with interest rates that are often 299 percent or higher, plus fees.

- More than 90 percent of the state’s more than 650 payday and title loan stores are owned by out-of-state companies.

- 1 in 8 title loan borrowers in Virginia has a vehicle repossessed each year, one of the nation’s highest rates.

- Lenders sell 79 percent of repossessed vehicles in the state because borrowers cannot afford to reclaim them.

So what does Pew recommend? Very clearly, Virginia legislators need to “moderniz[e] its small-loan laws,” and in so doing “reduce costs for their constituents, creating affordability for borrowers and a viable market for lenders, including lower-cost providers that currently avoid operating in the state because of its outdated laws, and saving families more than $100 million annually.”

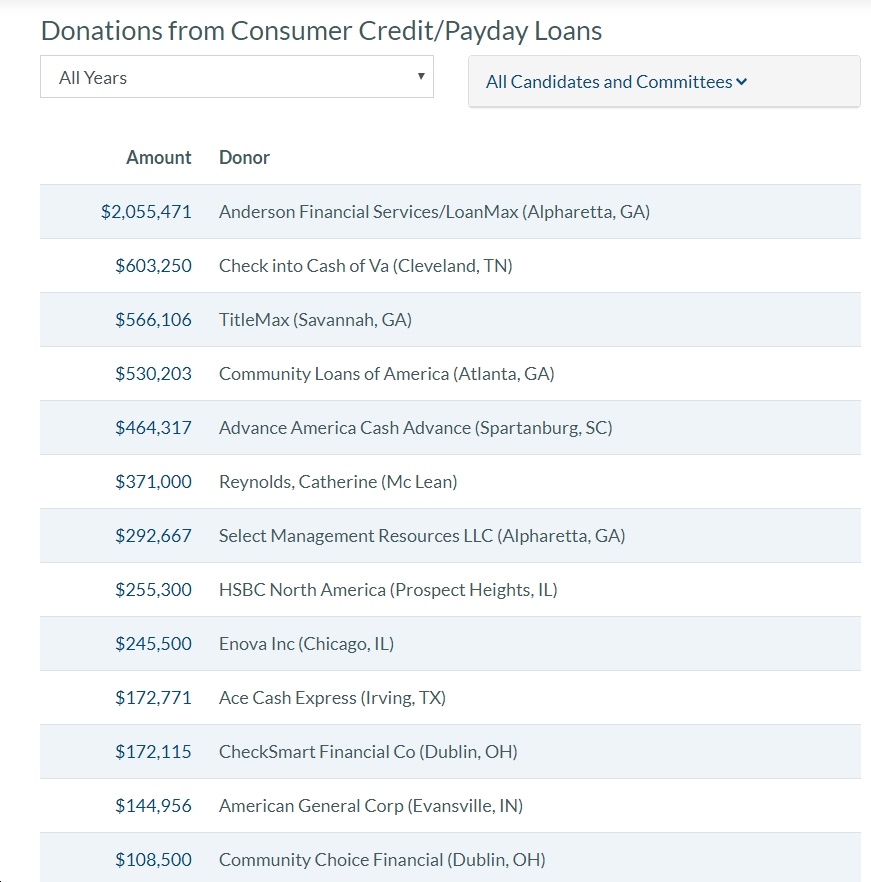

Of course, we do have one big obstacle to doing that here in Virginia – money, and LOTS of it, from the predatory lending industry to Virginia politicians. See below for the leaders, and for an idea of what we’re up against in terms of reform of this industry here in Virginia.