The following press release is from Virginia Excels (www.virginiaexcels.org), “a 501c3 education advocacy organization that is working for the day when every student in the Richmond region and across the Commonwealth has equitable access to an excellent public education, regardless of race or family income.” Note that Glenn Youngkin has continued to float the idea of ditching Virginia’s state income tax, which would *decimate* public education, as Virginia Excels’ new report finds…

*******************************

New Report Finds Eliminating Virginia’s Individual Income Tax Would Result in Billions in Cuts to K-12 Education Funding

Local School Divisions Would See $10 Billion in Cuts to State Funding Over The Biennium and 43,000 Educator Positions Would Be At Stake

September 7, 2021

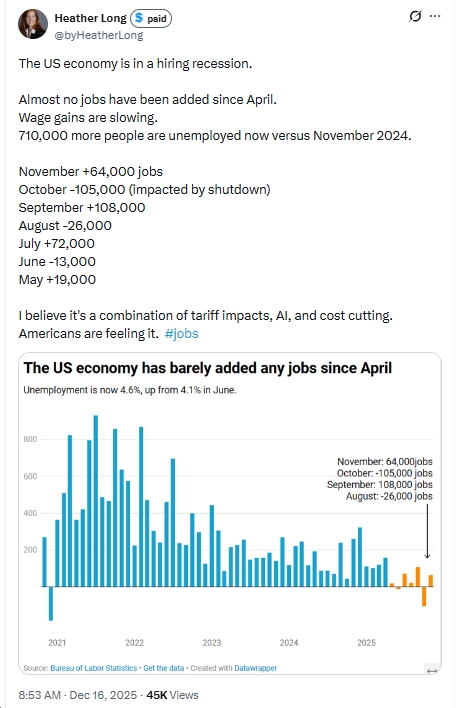

RICHMOND – Virginia Excels, an education advocacy organization focused on K-12 education, today released a report detailing the effects of eliminating the state individual income tax on K-12 education in Virginia. The report examines the impact of this policy proposal on local school divisions and finds, among other conclusions, that if applied evenly across the board, it would result in the loss of $10 billion in state funding per year for public education and 43,000 educator positions.

“Ensuring a high-quality education and recovering from the effects of the pandemic require more funding for K-12 education, not less,” said Taikein Cooper, executive director of Virginia Excels. “Eliminating these critical state resources would lead to poor outcomes for our students and the economy that depends on their success.”

The individual income tax provides $10 billion in funding for direct aid to K-12 education, comprising 56.4 percent of the $18 billion in total direct aid payments for the 2021-2022 biennium. Removing this critical source of funding would eliminate resources that are vital to Virginia students’ success, such as educator salaries, Career and Technical Education (CTE), special and gifted education, and more.

An analysis of the 2019-2020 school year revealed that eliminating the individual income tax would result in massive cuts to local school divisions. The below chart represents local impacts across the Commonwealth:

School Division | Cuts-Educator Positions(#) | Cuts-CTE Programs | Cuts-Special Education |

Fairfax | 2,889 | $400,000 | $3.5 million |

Richmond | 588 | $104,999 | $6.3 million |

Hampton | 867 | $847,500 | $4.6 million |

Bristol | 103 | $349,045 | $657,857 |

The full report can be found HERE.

About Virginia Excels

Virginia Excels is a 501c3 education advocacy organization that is working for the day when every student in the Richmond region and across the Commonwealth has equitable access to an excellent public education, regardless of race or family income. To learn more about Virginia Excels, visit www.virginiaexcels.org.

![Virginia NAACP: “This latest witch hunt [by the Trump administration] against [GMU] President Washington is a blatant attempt to intimidate those who champion diversity.”](https://bluevirginia.us/wp-content/uploads/2025/07/gmuwwashington.jpg)