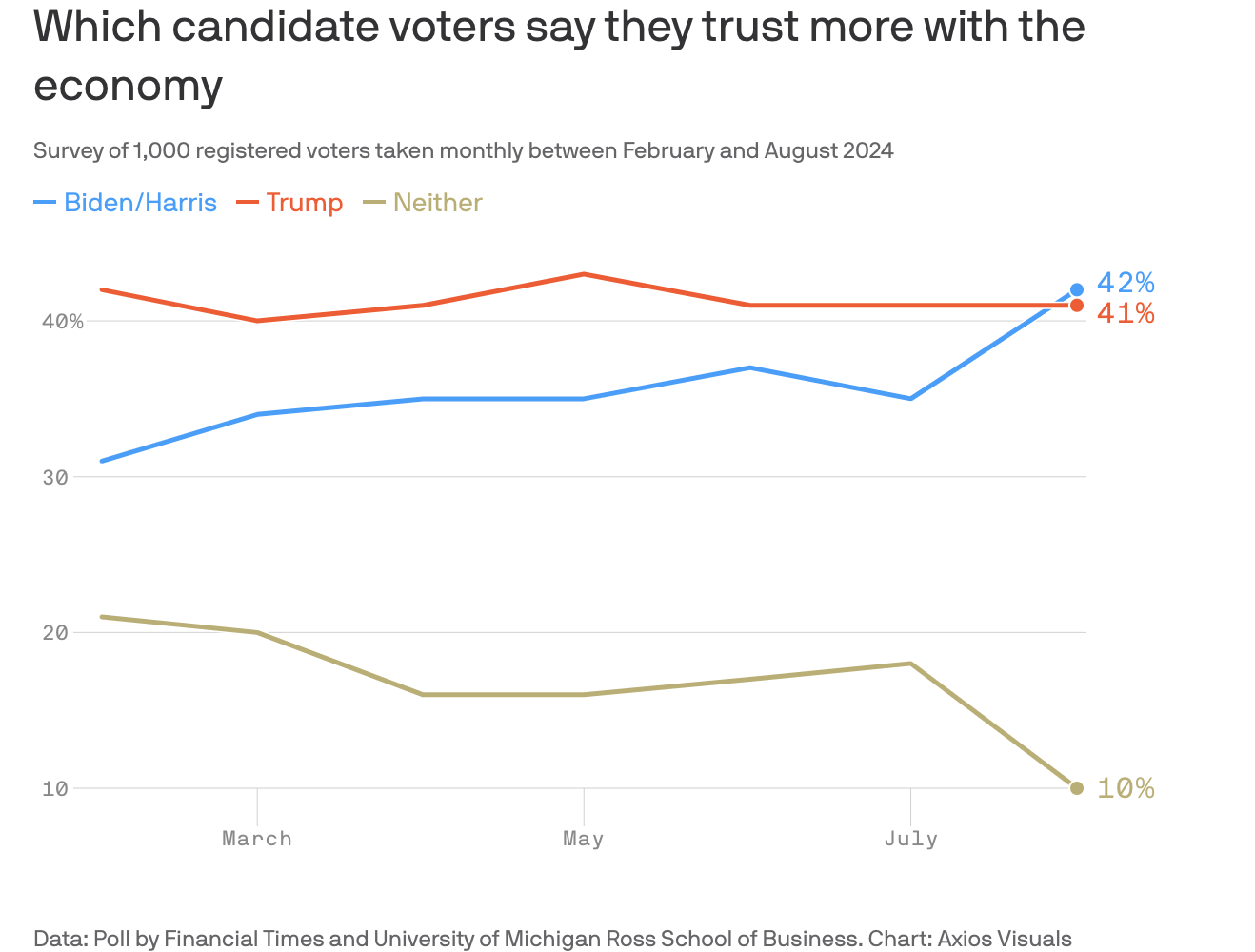

| Today’s strong PCE report continues to show inflation at a three-year low, while the Biden-Harris administration continues to work to lower costs and bolster the economy from the bottom up and middle out so that every American family can thrive. Under their leadership, annual PCE inflation is down to 2.5% and core annualized inflation is down to 2.6% — both the lowest in more than three years. Meanwhile, gas prices are down almost 50 cents from last year, the lowest Labor Day gas prices in three years, and wages are rising faster than prices and are up $1,400 since the pandemic for the typical worker. From taking on corporate greed and price gouging, to taking on credit card companies and Big Pharma and slashing junk fees – the Biden-Harris administration is making life more affordable for countless Americans. While Trump wants to rig the economy for his ultra-wealthy friends and greedy corporations, the Biden-Harris administration is holding price gougers accountable while fighting to ensure that every American has a fair shot. NEW: The latest PCE report shows inflation at a three-year low while the Biden-Harris administration continues to fight to bring costs down for hardworking Americans. Lael Brainard, Director of National Economic Council: “We are actually seeing relief at the pump, so $3.35 national average, that’s a reduction of about 50 cents since last Labor Day and the lowest Labor Day gas prices we’ve seen in three years.” White House Council of Economic Advisers: “Today’s Personal Income report shows that inflation came in as expected in July, with both headline and core PCE inflation at 0.2%. In addition, today’s data showed that consumption growth remained strong through July.” Carl Quintanilla, CNBC: “FITCH, on #PCE: “… This is a double dose of good news on inflation and economic growth. Inflation prints are slowly but surely becoming boring again as this report continues the recent streak of benign core and headline inflation prints. Consumer spending continues to surprisingly exceed all expectations, a clear indication that the economy continues to be in good shape …” A recent poll shows voters trust Vice President Harris more than Trump to handle the economy. Axios: “Voters trust Harris more than Trump on economy: poll”

The Hill: “More voters say they trust Vice President Harris to handle the economy than they do former President Trump, according to a poll released Monday by the Financial Times and the University of Michigan Ross School of Business.” REMINDER: Trump and Vance’s Project 2025 agenda would line the pockets of the ultra-wealthy and big corporations while raising taxes on low- and middle-income families. Center for American Progress: “Project 2025’s Tax Plan Would Raise Taxes on the Middle Class and Cut Taxes for the Wealthy” “In [Project 2025], far-right extremist plans are outlined that raise taxes on low- and middle-income households to finance tax cuts for the wealthy and large corporations. Project 2025’s tax plan includes an ‘intermediate tax reform’ that includes changes to tax brackets and corporate tax cuts that would shift the tax burden toward middle-income households… “The shift toward a flat consumption tax while eliminating income taxes would lead to an average $5,900 tax increase for the middle 20 percent of households and an average $2 million tax cut for the top 0.1 percent… “Project 2025’s new tax bracket system, however, represents an enormous shift of the tax burden from wealthy tax filers to middle-income tax filers. … The end result of these changes would be a tax increase for middle-class households. The median family of four made about $110,000 in 2022 and would experience about a $3,000 tax increase from this change. … In addition, the median one-person household made about $40,000 in 2022 and would experience a $950 tax increase under the plan… “Combining the changes to tax brackets, the cut in the tax rate on capital gains and dividends for the wealthy, and the elimination of the net investment income tax, this would deliver an average tax cut of up to $2.4 million for the 45,000 households making more than $10 million annually… “Project 2025 does not stop at cutting taxes for wealthy individuals; it also proposes an array of tax cuts for corporations. … This would amount to a $24 billion tax cut for the Fortune 100, the 100 largest companies in America… “[Project 2025] proposes replacing income and corporate taxes with a flat consumption tax as part of a ‘fundamental tax reform’… The lowest-income households (the bottom 20 percent) would pay $4,100 more in taxes, and middle-income households (the middle 20 percent) would pay $5,900 more. The top 1 percent, meanwhile, would see a $360,000 tax cut, and the top 0.1 percent would see a $2 million tax cut.” According to a recent study by Moody’s, Donald Trump’s MAGAnomics agenda could slow down economic growth and cause higher inflation, even triggering a recession by 2025. USA Today: “‘Biden’s policies are better for the economy,’ says Mark Zandi, chief economist of Moody’s Analytics. ‘They lead to more growth and less inflation. “According to a Moody’s study, Trump’s plan would trigger a recession by mid-2025 and an economy that grows an average 1.3% annually during his four-year term vs. 2.1% under Biden. (The latter is in line with average growth in the decade before the pandemic.) “Next year, under a Trump administration, inflation would rise from the current 3.3% to 3.6%, well above the 2.4% forecast under Biden, the Moody’s analysis shows. Compared with Biden, the U.S. would have 3.2 million fewer jobs and a 4.5% unemployment rate, a half percentage point higher, at the end of a Trump tenure.” Trump’s destructive MAGAnomics tax scam left middle-class families behind while giving tax handouts to the ultra-wealthy and big corporations. ITEP: “55 Corporations Paid $0 in Federal Taxes on 2020 Profits” New York Times: “How Big Companies Won New Tax Breaks From the Trump Administration” Forbes: “Trump Tax Cuts Helped Billionaires Pay Less Taxes Than The Working Class In 2018” CBS News: “Two years after Trump tax cuts, middle-class Americans are falling behind” The Guardian: “Donald Trump’s $1.5tn tax cuts have helped billionaires pay a lower rate than the working class for the first time in history.” Economic Policy Institute: “The TCJA overwhelmingly benefited the rich and corporations while overlooking working families” ProPublica: “In the first year after Trump signed the legislation, just 82 ultrawealthy households collectively walked away with more than $1 billion in total savings, an analysis of confidential tax records shows.” NPR: “More than 60% of the tax savings went to people in the top 20% of the income ladder, according to the nonpartisan Tax Policy Center. The measure also slashed the corporate tax rate by 40%.” |