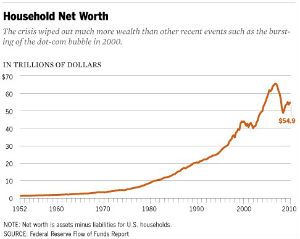

The myth of a strong economy heralded by the Bush administration unraveled in a series of Wall Street financial earthquakes. $11 trillion of America’s net worth dissolved; 8.5 million jobs were lost in the resulting recession. People’s homes weren’t worth what they paid for them. College graduates moved home.

The myth of a strong economy heralded by the Bush administration unraveled in a series of Wall Street financial earthquakes. $11 trillion of America’s net worth dissolved; 8.5 million jobs were lost in the resulting recession. People’s homes weren’t worth what they paid for them. College graduates moved home.

“The real story of this financial crisis is not so much whether the bailout was the right thing or the wrong thing to do. The real question is: How did it come to be?” – Phil Angelides, Chair, Financial Crisis Inquiry Committee

This beginning of a PBS Frontline documentary depicts the dramatic succession of events that led to and through the financial cataclysm that altered the economic landscape. In the first installment, events leading up to the 2008 crisis are brought into focus. Some of the key players are introduced. Most important is the development of a financial layman’s understanding of the complex machinations involved.

It didn’t begin with credit default obligations (CDOs) but that is as good a place as any to start explaining this mess. A group of innovators at JP Morgan developed the concept of a derivative to trade loan risks in the early 1990s. That is where the Frontline documentary begins the journey through a sorry tale of a failed economic credo and its victims.

Traditionally derivatives were a way to bet on the future value of something (futures). Farmers have relied upon futures for decades. The crew at JP Morgan invented a new kind, credit default swaps; a kind of derivative that insures a loan against default. Every time a bank makes a loan, it is required by regulation to set aside certain reserves of capital for the loan as a buffer against the loan not performing.

If a bank finds someone to share the risk, it compensates them for that as a premium for freeing up its capital for more loans. It makes it possible for a bank to skirt capital requirements. That allows banks to create more and more credit, for more and more loans. This conceptually allows them to shed the risks that they do not prefer and take on risks that they prefer.

The first customer was Exxon who had an $11 billion letter of credit as a result of the fallout from Exxon-Valdez. From that, JP Morgan created a portfolio of derivatives. These portfolios might represent hundreds of loans. This is characterized as an investment in a loan. A portfolio is tiered into different levels of risk (traunches) so investors could choose the level at which they were comfortable. This evolved into a market for derivative portfolios (synthetic collateralized debt obligations) that could be traded whether the bank owned them or not. The consequence of this new form of collateralization was that credit became more available. This new security was completely unanticipated and unregulated. It was an insurance product, designed not to be regulated as an insurance product. When a product is designed without regulation, capital and activity move into that market.

Credit is essential to the functioning of any economy. It is fundamental. This new trading venue grew exponentially and along with it the available credit; worldwide. It was a private, unregulated, invisible credit market. Opaque even to the buyers. That allowed banks to control the arbitrage of spreads in the values of contracts, an essential piece of financial leverage.

“You could just about drive by a bank and they would throw a loan paper at you as you pass by.” – former Georgia Democratic Governor Roy Barnes

Then followed portfolios of consumer credit risk. The higher the risk, the better. Banks began bundling mortgages in the same way they bundled corporate loans. This elevated the sub-prime market from niche to Wall Street. Where once only mortgage brokers who were specialists in this market dabbled in these loans, now that they could be securitized, everyone was interested. As home prices escalated, lending abuses became a tidal wave across the United States. JP Morgan, the inventor of the derivatives, however, walked away from this realm of investment risk.

Borrowers were getting loans at values greater than their homes and without income. The elderly and the low income had no clue what they signed.

- high interest rates

- high points

- prepayment penalties

- balloon payments

- adjustable rate mortgages

Why? They did it because they could.

Citicorp led the charge to roll back Glass-Steagall. This is precisely where everything accelerated in the wrong direction. A smiling Bill Clinton signed the bill championed by the likes of Alan Greenspan, Chair of the Federal Reserve. The markets will clean themselves up. If there is a problem, we will clean up afterwards. This was characteristic of the leadership Greenspan employed in his 20 years at the Fed.

There were voices in Congress calling out for derivative regulation. Senator Byron Dorgan (D-ND) predicted the collapse. Brooksley Born, Chair of the Commodity Futures Trading Commission, told Congress that if there were no regulation put in place, risk would build up that would lead to a collapse of the financial sector. The banks lobbied successfully against derivative regulation.

They were making money and they wanted to continue making money. It was generating fees. Transparency drives profits down, drives down transaction costs. The banks don’t want that, because they make their money from transaction costs. And they like lots of non-transparency. – Joseph Stiglitz, Economist, Columbia University

Global markets relied upon stability in the American financial institutions. Out of the Great Depression had been forged a most reliable banking and investment system. The European Bank for Reconstruction and Development naively went full in for these new derivatives. Wall Street and the champions of the free market betrayed that trust.

By the end of 2005 the total of credit default swaps around the world was measured in trillions of dollars and doubling every year. It was the epitome of the conservative’s concept of capitalism: the combination of free market, innovation and globalization; highly complex and highly risky.

It all began to come undone in late 2006 when housing prices started to drop. By 2007 and 2008, all the smart money knew the game was over and began to repackage their exposure to ameliorate the risk they had assumed by getting them off the books. At the same time, they wanted to take advantage of the market decline. One of the biggest players was Goldman Sachs. Goldman Sachs created a series of CDOs containing toxic sub-prime loans and sold them while using credit default swaps betting against them. They bet against their own clients.

In 2007, the German bank, IKB was the first to fail. The trust in American financial institutions was betrayed.

Ground zero of the sub-prime collapse was and is local neighborhoods. The areas with the highest growth during the bubble felt the greatest effect. Cities throughout the United States saw a rise in vacant and abandoned properties. That is what the neighbors witnessed, not the CDOs, the demise of the derivatives, and their affects on the banking and investment sector.

Neighborhoods and cities cannot survive with a growing inventory of vacant and abandoned properties. Some properties’ ownership is indecipherable because the loans have been sliced and diced so many times there is no trail. Ownership is in a loan that is lost inside a huge financial vehicle. Home ownership is lost in a billion dollar package with no one assigned to look after it, leaving them empty and decaying.

“The greed of Wall Street broke Main Street.” – former Georgia Democratic Governor Roy Barnes

The financial collapse follows.

![[UPDATED with Official Announcement] Audio: VA Del. Dan Helmer Says He’s Running for Congress in the Newly Drawn VA07, Has “the endorsement of 40 [House of Delegates] colleagues”](https://bluevirginia.us/wp-content/uploads/2026/02/helmermontage.jpg)