by Lowell

by Lowell

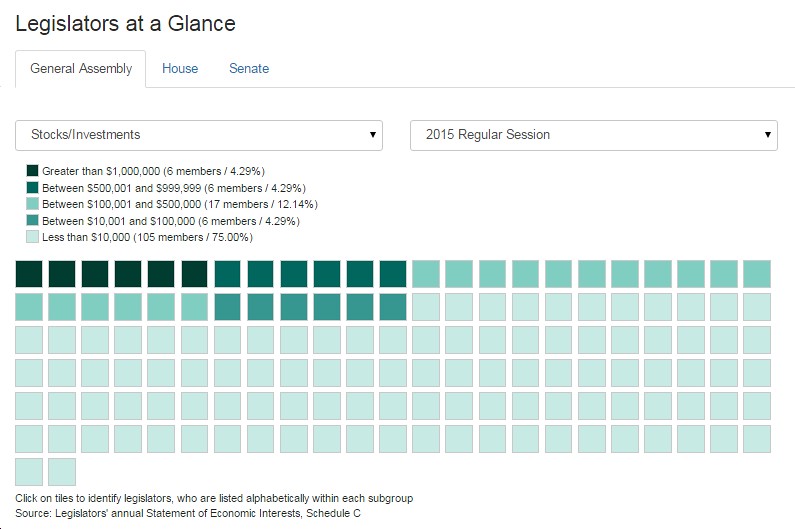

UPDATE 6:24 PM: After assuring me multiple times that their numbers were accurately presented on their website, the VPAP folks now tell me that they actually were wrong. They’ve apologized and stated that they definitely didn’t “live up to our own standards” on this one. Uhhhh…alrighty then. Anyway, given the changes, my analysis of course will change, especially since VPAP’s new/improved/corrected (let’s hope!) numbers now show just 22% of General Assembly members under $10k in stocks/investments, with 16% between $10k and $100k, 38% between $100k and $500k, 11% between $500k and $999,999; and 13% over $1 million. What to make of this? I still think Virginia’s got a horrendously bad system for ethics, that “disclosure” is not even close to sufficient as a counter to all kinds of shenanigans, and basically that this entire system reeks to high heaven. Other than that, it makes a lot more sense to see that the well-to-do members of our General Assembly actually admit to having significant stocks and investments. Still, none of this leaves me with a warm/fuzzy feeling…

You’re probably aware that in Virginia, almost anything goes when it comes to financing political candidates and elected officials. That includes essentially unlimited donations even from individuals and corporations (e.g., Dominion Power) with pending and/or current business before the very elected officials they’re donating money to! That, in turn, is the very defintion of “legalized corruption.”

The one “check” in Virginia’s pathetic “ethics” system regarding money in politics is supposed to be “full disclosure”/”transparency,” particularly on the Virginia Public Access Project (VPAP) website. Of course, the fact is that only a miniscule percentage of Virginians probably even know that VPAP exists, let alone have ever used it. In addition, VPAP only reports the information it’s given; it has no investigatory, let alone enforcement, powers to speak of. But even with regard to reporting the information it’s given, there’s the good old “garbage in/garbage out” problem: if the information VPAP receives is utter crap, then the information they display on their website will be…yep, you guessed, it utter crap as well!

Case in point: check out VPAP’s “Legislators at a Glance” page regarding stocks/investments by members of the Virginia General Assembly. Anything jump right out at you? Like, for instance, that supposedly 75% of Virginia General Assembly members – almost none of whom are hurting financially – report less than $10k in stocks/investments? And that nearly 80% report $100k or less in stocks/investments? Seriously? We’re actually supposed to believe this is accurate? Quick quiz: how many of were born yesterday?

What on earth is going on here? I’ve asked around, and as far as I can determine it’s probably a combination of things. First off, the requirements in Schedule C (“Statement of Economic Interests: Securities”) are a combination of opaque, inscrutable and utterly bizarre. Thus, for instance:

- “‘SECURITIES’ INCLUDES stocks, bonds, mutual funds, limited partnerships, and commodity futures contracts.

- “‘SECURITIES’ EXCLUDES certificates of deposit, money market funds, annuity contracts, and insurance policies.”

- “Identify each business or Virginia governmental entity in which you or a member of your immediate family, directly or indirectly, separately or together, own securities valued in excess of $5,000. Name each issuer and type of security individually.”

- “Do not list U.S. Bonds or other government securities not issued by the Commonwealth of Virginia or its authorities, agencies, or local governments.”

- “Do not list organizations that do not do business in this Commonwealth, but most major businesses conduct business in Virginia. Account for securities held in trust.”

By the way, this system isn’t just flawed, it could be even more problematic than that. According to white collar defense attorney David Benowitz, a founding partner Price Benowitz LLP: “The lack of consensus regarding which types of campaign funds must be reported in Virginia could almost certainly give rise to legal issues or potential criminal liability for incumbents and candidates alike. Considering the highly-charged nature of public elections, this is a situation that bears monitoring as we approach next year’s election season.”