by Tom Hicks, a resident of Montpelier, VA and a Democratic Candidate for Congress in Virginia’s 1st Congressional District. His website is: https://tomhicks4congress.org/

The US Congress is currently considering various federal tax reform proposals for both businesses and individuals. Our country needs pro-growth tax policies, but not all tax changes have equivalent, or even positive, effects on long-term growth and federal tax revenues. Business tax reform should take priority given that it has a greater need and will have a more powerful impact on economic growth.

US business tax structure has not kept up with other industrialized nations. US business statutory tax rates are mostly higher than our overseas competitors. US average and effective corporate tax rates are also near the top of the list of G20 countries. All three types of corporate tax rates affect a company’s decision regarding investments and tax avoidance but each influences these choices differently. These differentials in rates provide an incentive for businesses to shift investment, earnings and jobs overseas.

Lowering the US top business tax rate to the 25% range, combined with a minimum tax approach and an end to deferrals on foreign taxes owed, would encourage more business investment and job creation in America and discourage tax avoidance. A minimum tax system would tax multinational foreign profits at a rate that reflects the difference between the US rate (e.g. 25%) and the rate paid in the foreign country, essentially by providing credits for taxes paid to foreign governments. This approach is preferable to the “territorial” tax system that would provide greater tax incentives for multinational corporations to invest and move profits overseas, and would lower federal tax revenue since multinational companies would only pay the taxes on foreign earnings to the foreign country.

The end of tax deferrals would prevent multinationals from parking their earnings overseas and postponing indefinitely paying any US tax on those earnings. Furthermore, by using other offsets in the tax code, e.g., treatment of carried interest and reduced business deductions for net interest expense, this reform should be accomplished on a federal tax revenue neutral basis as determined by Congressional Budget Office scoring. Furthermore, the offsets should not negatively impact middle and low income families or important safety net programs.

As part of this business tax reform, existing overseas business profits that have not been repatriated (estimated to be over $2 trillion) could be repatriated and taxed at a one-time lower rate, e.g., 10%, to generate over $200 billion in federal revenue that could be used to fund infrastructure and job training programs.

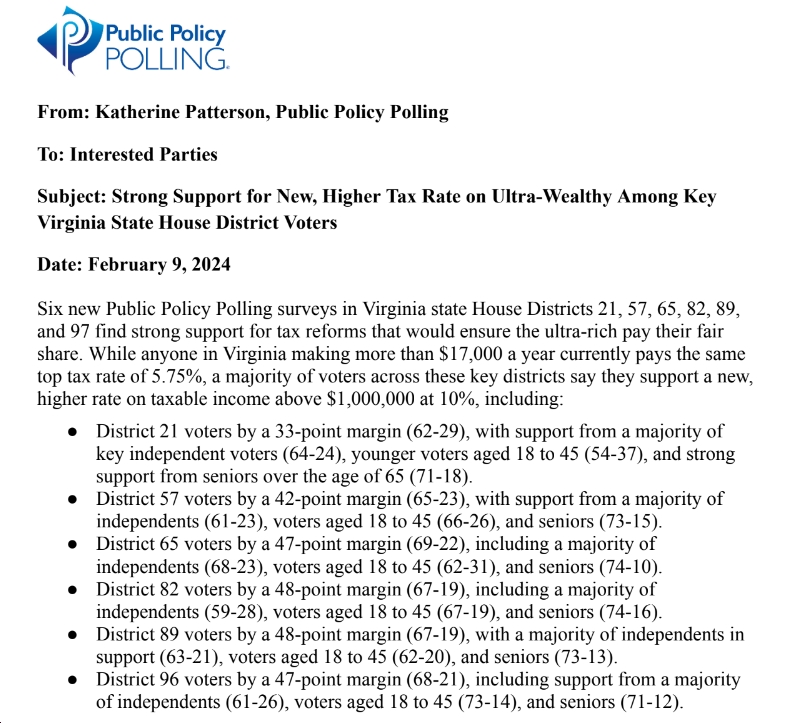

In contrast to business tax reform, cuts in individual tax rates for high income wage earners have not been shown by independent economic studies to consistently create economic growth over the long term and will result in a decrease in federal tax revenue. A 2016 study by the Brookings Institution and Tax Policy Center concluded that tax cuts as a stand-alone policy will typically raise the federal budget deficit. According to a Tax Policy Center report released in July 2017, the budget proposal by the Trump administration to cut individual taxes without offsetting tax changes could reduce federal tax revenue by as much as $3 trillion over a decade and would mostly flow to the wealthiest 1 percent of all households.

Another Republican proposal for individual tax cuts for high income tax payers that was included in the House healthcare reform bill would have reduced federal revenue by hundreds of billions of dollars, would not have created growth, and would not have been beneficial to middle income, working class families in America. With a federal deficit in the 2017 budget year alone of over $690 billion, and higher deficits in out years, new tax policies must be crafted so as to not exacerbate our federal deficit crisis. In May of this year, former Fed Chairman Ben Bernanke pressed for infrastructure spending and tax reform, saying they would benefit the economy more than tax cuts.

We need federal tax policy that increases economic growth to the benefit of all Americans, maintains or increases federal tax revenue, and does not use funding cuts in safety net programs, important programs for scientific research and critical environmental protection programs like the Chesapeake Bay Program to offset the loss in federal revenue projected from the tax cut. Revenue neutral business tax reform will accomplish this goal. Individual tax cuts will not.