by A Siegel, cross posted from Get Energy Smart! Now!

A well-used (often relevant) adage

Never let a good crisis go to waste.

While not wanting to suggest that a global pandemic is in any way a “good,” this crisis does create opportunity for action (and not just for unethical Amazon vendor price gouging). Clean energy investing, across the economy, is a prime example of this.

Interest rates are plummeting and, with the world economy taking significant hits already from the coronavirus (such as empty airports, canceled meetings, and reduced frequenting of restaurants), there is no window in sight for their going back up.

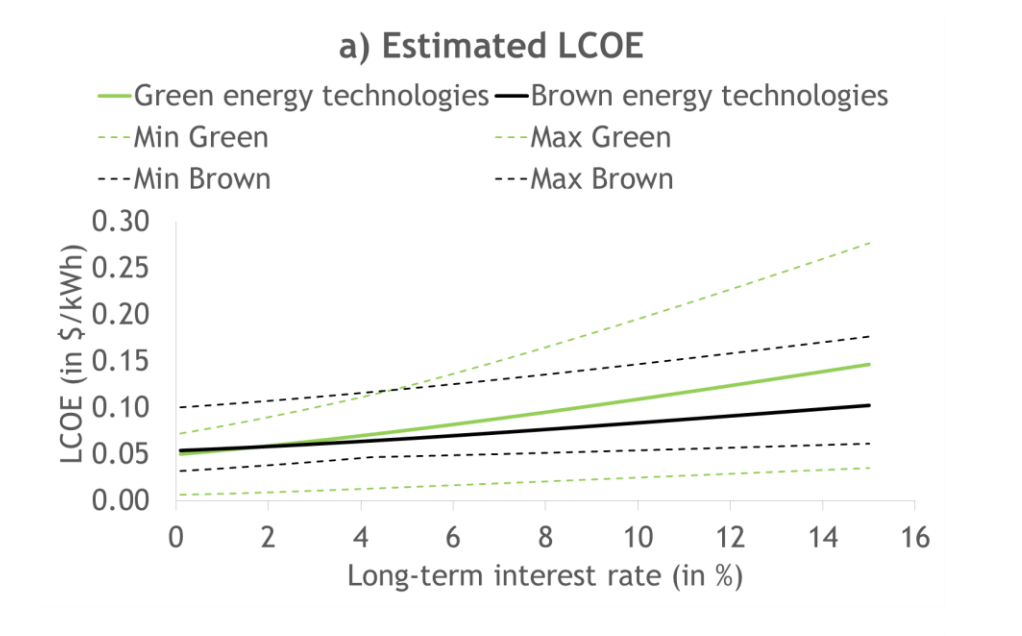

Low interest rates are perfect for taking “infrastructure week” seriously. And, within this, especially relevant for a clean energy economy as clean-energy options (solar, wind, batteries, efficiency) are higher cost-to-buy while lower cost-to-own options requiring upfront investments for longer-term benefits. This makes interest rates a key determinate factor for the levelized cost of energy (LCOE) — the cost of electricity — from renewable sources. In other words, “Interest rates are a decisive factor for competitive renewables“. A study found that about 25 percent of the reduction in wind electricity prices in Germany occurred due to lower interest rates. For investors, higher interest rates lower (quite significantly) the value of renewable energy investing. Lower interest rates translate, quite directly, into lower renewable energy costs and greater investor interest in renewable energy projects.

Now, turn the conversation to Virginia. One of the major legislative achievements (amid a huge number of achievements) was the passage of the Virginia Clean Economy Act (VCEA), which includes a mandate for 100 clean power (electricity) by 2045 with significant requirements for a major ramping up of renewable (wind and solar) resources over the coming decades.

As an aside, regretfully, Virginia’s legislators (seemingly to a person) have been working with a false assumption: that going clean will cost more than remaining with a polluting energy system. That has long been a fossil foolish operating assumption that totally ignores real costs (e.g., the impacts negative externalities from burning fossil fuels) Plunging renewable prices over the past decade make this a less accurate belief even within the most-stove-piped look solely at “ratepayer costs.” (Seriously, the closer you look, the better renewables have looked financially every single day over the past decade.) The significant decrease in interest rates make claims that “going clean costs more” even less truthful.

For a perspective on how interest rates can impact clean energy options, consider this 2015-look from the Center on Economic Policies. (To be clear, “five-year-old” matters: renewable investment costs have fallen significantly in the intervening time period while polluting energy options have, writ large increased in price.) All things being equal, as interest rates fall, “green energy technologies” become more competitive.

And, even back in 2015 with much higher renewable energy investment costs, “going green” was cost advantaged by about a two-percent interest rate. Where are those interest rates now?

Hmm, the govt can borrow money ridiculously cheaply for 10 years. Is there anything we have to build within 10 years* that would cost lots of money? Maybe now would be the time to start? *Please, instead of @‘ing me re: 10 yrs, read this, then get to work https://t.co/9zmJw5mjCp https://t.co/V5KPVubBIR

— Costa Samaras (@CostaSamaras) March 9, 2020

In any event, even working with the false assumption that “clean costs more,” Democrats in the Virginia legislature passed legislation this session requiring a move off of polluting coal and natural gas in the power sector. This is phased in over a 25-year period, even as a key analysis (with many flawed pessimistic assumptions) showed the highest return on investment would be a ten-year project and even as a back-of-the-envelope effort makes clear that a 15-20 year (2035-2040) target was entirely possible and affordable.

All of this, however, was before coronavirus impacts – with collapsing interest rates and reduced business/economic activity – really started to kick in. We now have very clear indications that the global economy will require significant stimulus activity in the coming months and years. Turning to the “opportunity” part of the “crisis/opportunity,” extremely low interest rates mean that borrowing for infrastructure (including clean energy) is incredibly affordable and that infrastructure investments are highly stimulative.

A rough (plus-or-minus, dependent on the situation) rule of thumb: a one percent change in interest rates translates into about one cent per kilowatt cost for renewable energy. Drop the cost of money by a percent, reduce the cost of electricity by 1 cent per kilowatt hour.

Using these sort of rough rule-of-thumb guidance, consider just one arena: offshore wind. In Massachusetts, Mayflower Wind has now come in lower than expected, 5.8 cents per kilowatt hour (kWh) (below the targeted 6.5 cents per kWh). With a reverse auctioning process, Virginia’s offshore wind (with the exact same financing structures) should come in below that. The VCEA envisions 5.2 gigawatts of offshore wind. This easily $15-$20 billion project will lead to 10,000s of jobs and significant amounts of clean electrons into the economy.

Perhaps looking too far back into the history of offshore wind prices, Virginia’s legislators have acted as if this would drive increased costs to consumers. Putting aside the significant benefit from reducing peak pricing impacts, the plunging price of offshore wind projects around the world and the low prices emerging for other U.S. East Coast offshore wind projects, a reasonable price (LCOE) for a large-scale Virginia offshore wind project should have been in the range of 5.5 to 6 cents per kilowatt hour. “Should have been” with interest rates of February 1, 2020. With the interest rates we are now seeing, it might be reasonable to expect that a well-managed (with an open reverse auction and some leveraging of Commonwealth’s AAA Bond rating) Virginia Offshore Wind project should be able to deliver clean electricity at below 5 cents per kilowatt hour.

Our economy needs stimulus in the face of coronavirus impacts.

The necessity to move to a clean economy is clear and Virginia now has a legislative mandate to transition to a clean economy.

Low interest rates have made it even cheaper and fiscally advantageous to accelerate that transition.

Virginia shouldn’t let a good crisis go to waste:

- save money by

- leveraging low interest rates to

- create good jobs and substantial economic activity by

- accelerating moves to a clean economy.

![Sunday News: “Trump Is Briefed on Options for Striking Iran as Protests Continue”; “Trump and Vance Are Fanning the Flames. Again”; “Shooting death of [Renee Good] matters to all of us”; “Fascism or freedom? The choice is yours”](https://bluevirginia.us/wp-content/uploads/2026/01/montage011126.jpg)

![New Year’s Day 2026 News: Full Video of Jack Smith Testimony – “The attack that happened at the Capitol…does not happen without [Trump]”; Trump/RFK Jr Make Measles Great Again; Right-Wing YouTuber Nick Shirley Definitely Not a Real Journalist; Musk Did Enormous Damage in 2025](https://bluevirginia.us/wp-content/uploads/2026/01/montage010126.jpg)