From the Commonwealth Institute for Fiscal Analysis:

NEW POLL: VIRGINIA VOTERS SAY ENSURING WEALTHY & CORPORATIONS PAY THEIR FAIR SHARE IN TAXES IS A TOP PRIORITY

By more than 2 to 1, Virginia voters support Biden’s $3.5 trillion Build Back Better plan to help working families, paid for by raising taxes on the wealthy and corporations

New letter signed by 37 Virginia groups calls on delegation to support Biden tax plan

RICHMOND, VA – The Commonwealth Institute for Fiscal Analysis, Virginia Organizing, and Americans for Tax Fairness released new polling today showing that Virginians overwhelmingly support paying for the critical needs of Virginia families by ensuring the wealthy and corporations pay their fair share in taxes. The polling comes as the U.S. Senate this week begins debating and voting on President Biden’s $3.5 trillion Build Back Better plan that would make healthcare, eldercare, childcare, education, and housing more affordable for families. It is primarily paid for by raising taxes on the rich and corporations. People making less than $400,000 a year will not pay more in taxes.

The poll comes out as Senators Mark Warner and Tim Kaine prepare to vote on the Senate budget resolution, which will pave the way for lawmakers to begin the budget reconciliation process that will allow Biden’s Build Back Better agenda to pass with 50 votes. Sen. Warner is a key member of the Senate Budget Committee and the Senate Finance Committee.

The groups also released a letter signed by 37 Virginia groups to Virginia’s congressional delegation in support of President Biden’s Build Back Better plan of new investments financed largely by raising taxes on the wealthy and corporations — and not by raising taxes on anyone making under $400,000 a year.

“This poll shows that a strong majority of VA voters support raising the corporate tax rate from 21% to 28%,” said Ashley Kenneth, President, and CEO of The Commonwealth Institute for Fiscal Analysis. “Virginians support the Build Back Better plan and we are calling on Senators Warner and Kaine and the rest of our congressional delegation to deliver what all our families deserve and what this poll shows that people in Virginia want: an equitable recovery and tax justice to fund our future and the investments that would help build an economy that works for all of us.”

“With the different challenges we are seeing, there are 37 organizations from Virginia including congregations, unions, environmental rights organizations, and grassroots organizations, who have submitted a letter about the need for tax fairness,” said Karen Downing, leader of the Eastern Shore Chapter of Virginia Organizing. “We want to ensure that our voices are heard.”

“I am proud to sign the letter calling for Senator Warner to support real tax fairness,” said Anita Royston, President of the Pittsylvania NAACP.

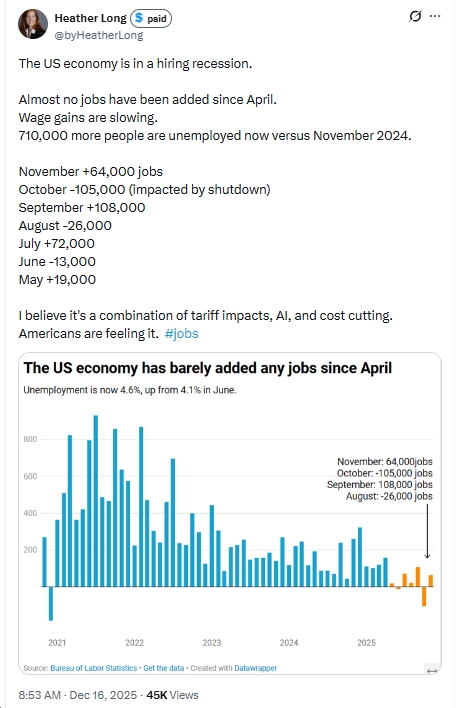

The Virginia poll conducted July 10-14 by Hart Research and ALG Research surveyed 505 registered voters with a ±4.5 margin of error. Its key findings include:

- Ensuring that the wealthy and corporations pay their fair share in taxes is a top priority for Virginia voters today, even ahead of important goals like rebuilding infrastructure or expanding access to eldercare.

- Two-thirds (68%) of Virginia voters support President Biden’s American Families Plan, which is essentially Biden’s Build Back Better Plan, and see his proposals to raise taxes on the wealthy and corporations as a strong reason to support it.

- Biden’s proposals to raise taxes on those making over $400,000 meet with wide approval (72% support) in Virginia, including his proposal to tax capital gains at a similar rate as income from wages (63% support). Voters believe that raising taxes on those earning $400,000 or more will help the economy by a 38-point margin.

- Increasing the corporate tax rate to 28% is embraced by 59% of Virginia voters, who also favor taxing foreign profits at 28% (68% support), and setting a minimum corporate tax rate of 15%.

- Virginia voters would go even further than President Biden in raising taxes on the wealthy, embracing proposals to establish a wealth tax (70% support), expand the estate tax (60% support), and apply the estate tax to estates valued at $3.5 million (60% support) – currently only estates valued above $11.7 million are taxed.

- Swing voters in next year’s congressional election are particularly motivated by tax fairness concerns and consistently support progressive tax policies at a higher level than the electorate overall.

You can find a detailed memo from Hart Research and ALG Research here. A PowerPoint deck is here.

####

About The Commonwealth Institute

The Commonwealth Institute for Fiscal Analysis advances racial and economic justice in Virginia by advocating for public policies that are designed in partnership with people most impacted, and shaped by credible, accessible fiscal and policy research. Our independent research and analysis drives key state budget, legislative, and policy changes that break down barriers and create opportunity for people and communities across Virginia. Visit www.thecommonwealthinstitute.org for more information.

![Thursday News: “Europe draws red line on Greenland after a year of trying to pacify Trump”; “ICE Agent Kills Woman, DHS Tells Obvious, Insane Lies About It”; “Trump’s DOJ sued Virginia. Our attorney general surrendered”; “Political domino effect hits Alexandria as Sen. Ebbin [to resign] to join Spanberger administration”](https://bluevirginia.us/wp-content/uploads/2026/01/montage010826.jpg)