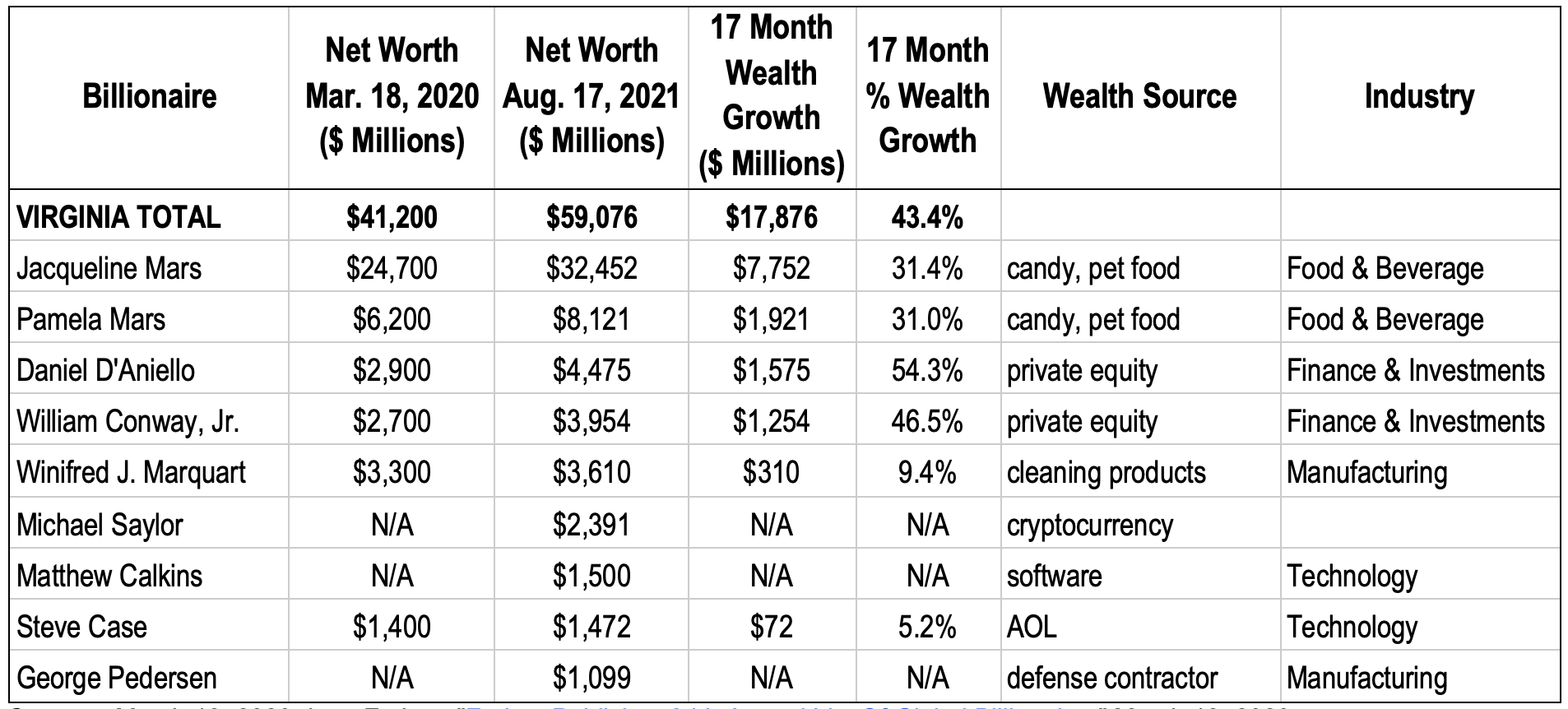

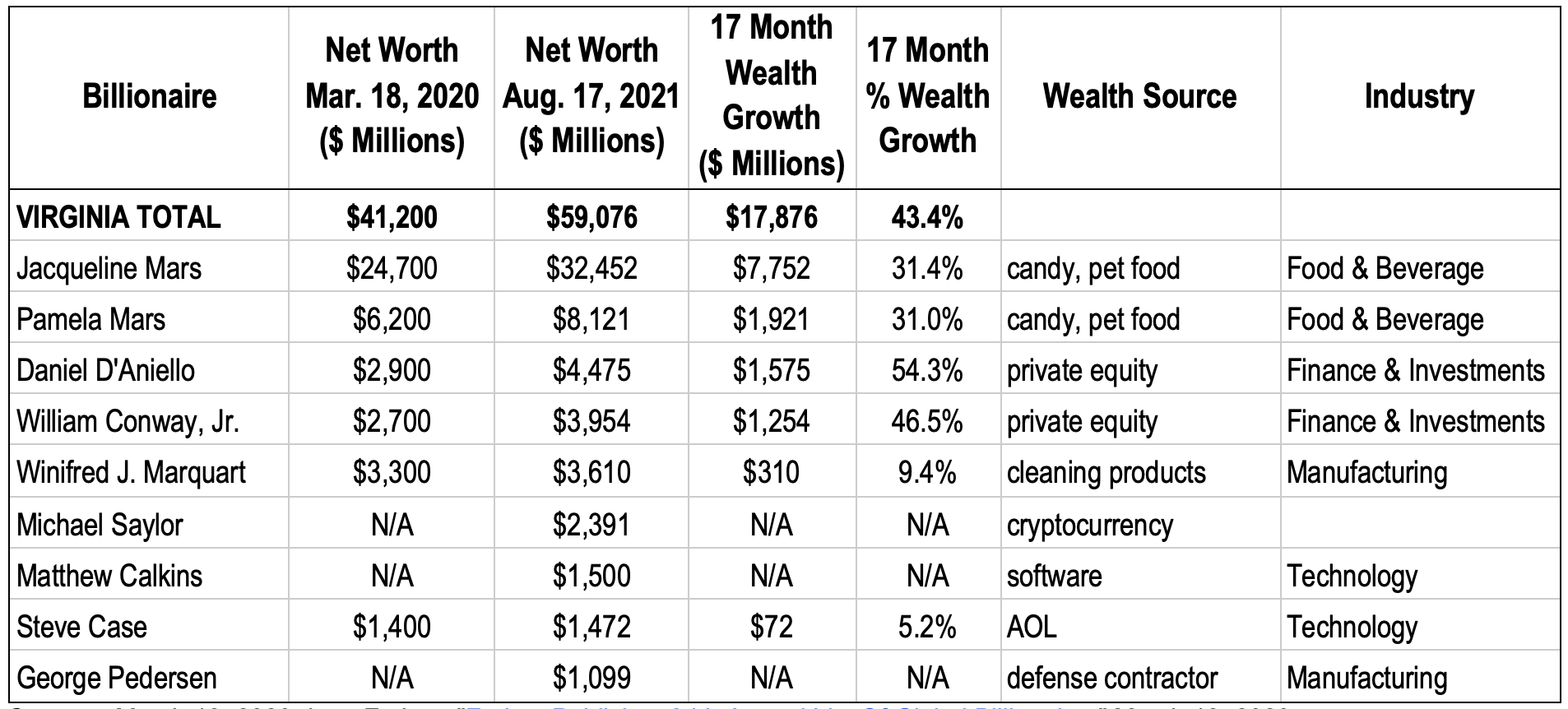

| The state’s billionaire wealth bonanza over the past 17 months is all the more appalling when contrasted with the devastating impact of coronavirus on working people. In Virginia: 1,762,586 have lost jobs, over 731,000 have been sickened by the virus, and over 11,600 have died from it. President Biden’s investment proposals contained in the Senate and House-passed budget resolutions would significantly improve Virginia residents’ health by making private insurance in the Affordable Care Act (ACA) exchanges more affordable; expanding Medicare to cover dental, vision, and hearing benefits; increasing long-term care benefits to help people afford home and community-based services; and lowering the cost of prescription drugs by giving Medicare the authority to negotiate lower prices with drug corporations. Biden’s proposed investments would reduce health insurance premiums for 9 million people. An average 60-year-old in Virginia making $55,000 annually would save over $600 on their monthly premium for an ACA insurance policy. The cost of extending these subsidies is $163 billion over 10 years, per the Treasury Department. That means the $18 billion increase in Virginia billionaire wealth over the last 17 months could pay for 11 percent of the entire 10-year cost of making health care more affordable for 9 million people. While these investments in health care would benefit millions of Americans and save money in the long run, the ballooning wealth of billionaires benefits no one but the super-rich. That’s because the current tax code is riddled with loopholes and special breaks that allow the super wealthy to avoid paying their fair share of taxes. Due to one of the tax code’s biggest loopholes, increased wealth enjoyed by Virginia billionaires can go untaxed forever. The same is true for all asset growth, which is the primary source of income for the rich. The virtual tax-free status of billionaire wealth growth was highlighted recently by a report from ProPublica. It estimated that 25 top billionaires paid on average just 3.4 percent of their wealth-growth in federal income taxes and that several, including Jeff Bezos (worth $188 billion on Aug. 17) and Elon Musk (worth $175 billion), went multiple recent years paying zero federal income tax. Even when taxed, the top tax rate on income generated from wealth (such as the sale of stock or a business or a famous painting) is only about half that of wage income—20 percent vs. 37. President Biden would end those special breaks on the wealth-growth income of millionaires and billionaires as part of his tax-reform package. Following are Biden’s tax reforms expected to be a part of budget reconciliation legislation to be voted on in the fall, many of which will ensure Virginia billionaires start paying closer to their fair share to taxes: - Tax wealth like work. People with more than $1 million a year in income will have to pay a top tax rate on the sale of stock and other assets that is the same as the top rate workers pay on wages. Biden also will close a loophole that often allows the wealthy to avoid paying taxes on investment gains for their entire lives. These reforms will raise $325 billion.

- Restore the top individual tax rate to 39.6 percent and stop avoidance of taxes by wealthy business owners that are used to fund health care. These two reforms will together raise $370 billion.

- Crack down on tax evasion by the wealthy, which will raise $700 billion.

- Raise the corporate tax rate from 21 to 28 percent, leaving it still far below the 35 percent rate in 2017. Corporate taxes are largely paid by the owners of corporations, the stockholders. Billionaires are among the wealthiest 1 percent that own over half of all corporate stock. This reform will raise nearly $900 billion.

- Curb offshore corporate tax dodging by eliminating incentives to outsource jobs and shift profits to tax havens. This reform will raise more than $1 trillion.

A more direct way to tax billionaire wealth is to tax the wealth itself instead of just its growth. If the wealth tax proposed by Sen. Elizabeth Warren had been in effect in 2020, the nation’s billionaires alone would have paid $114 billion for that year—and would pay an estimated combined total of $1.4 trillion over 10 years. Poll after poll shows that Americans of all political persuasions and by large majorities believe that the wealthy and big corporations need to start paying their fair share of taxes. A June poll by ALG Research and Hart Research shows 62% of voters support Biden’s proposed $4 trillion (at the time) investments in health care, childcare, education, clean energy and more—paid for by higher taxes on the rich and corporations. Virginia voters are no exception: according to a poll of 500 state voters in July, by 66 percent to 29 percent, Virginia voters support Biden’s $3.5 trillion Build Back Better plan to help working families, paid for by raising taxes on the wealthy and corporations. March 18, 2020 is used as the unofficial beginning of the coronavirus crisis because by then most federal and state economic restrictions responding to the virus were in place. March 18 was also the date that Forbes picked to measure billionaire wealth for the 2020 edition of its annual billionaires’ report, which provided a baseline that ATF and HCAN compare periodically with real-time data from the Forbes website. PolitiFact has favorably reviewed this methodology. |