Why are oil and gasoline prices rising? There are many supposed explanations out there, mostly by people who – to put it mildly – are not oil market experts, economists, etc. Those include a bunch of flat-out false statements by Republicans, which not surprisingly have no relationship to what’s actually going on in oil markets, and which dishonestly (and in bad faith) attempt to place all the blame for everything on…yep, you guessed it, the Democrats, Joe Biden, etc.

As for Democrats, they’re absolutely correct in pointing at the market’s reaction to the Russia crisis – including sanctions on Russian oil, the threat of further oil supply disruptions from Russia, etc. They are also correct in pointing at the impact of COVID-19, first on massively *depressing* economic activity (which collapsed), oil demand (which plummeted) and oil supply (ditto) in 2020 (when Trump was president); now with a massive economic and oil demand recovery, combined with “supply-chain” issues related to COVID-19 pandemic’s disruptions. And Democrats are right to point to America’s continued addiction to oil – which we should have broken years ago – as a major contributing factor to this entire situation. The one area where Democrats aren’t really accurate is that oil companies are “gouging”; there’s simply no evidence of that. But Democrats are right on everything else, while Republicans are wrong on literally *everything* about this situation.

Don’t believe someone (raises hand) who worked as an international energy markets analyst/economist for 17+ years at the US Energy Information Administration? Fine, but do you also not believe the following experts on this topic? For instance:

Here’s what the International Energy Agency, which is one of the world’s top authorities on oil markets, had to say recently, basically that it’s a combo of…yep, world oil supply not keeping pace with surging world oil demand, combined with “rising geopolitical tensions”:

- “Chronic underperformance by OPEC+ in meeting its output targets and rising geopolitical tensions have propelled oil prices higher.”

- “OECD industry oil inventories plunged by a hefty 60 mb in December, to stand 255 mb below the five-year average and at their lowest level in seven years.“

- “World oil demand is set to rise by 3.2 mb/d in 2022 as restrictions to limit the spread of Covid ease, releasing pent-up demand.”

Next, here’s a superb fact check by the NY Times, which finds:

- Some of the Republicans’ most frequent false claims for why oil prices are rising – the Keystone XL pipeline, oil and gas leases, etc. – in fact “have had little impact on prices.”

- “The primary reason for rising gas prices over the past year is the coronavirus pandemic and its disruptions to global supply and demand.“

- “Covid changed the game, not President Biden…In the early months of 2020, when the virus took hold, demand for oil dried up and prices plummeted, with the benchmark price for crude oil in the United States falling to negative $37.63 that April. In response, producers in the United States and around the world began decreasing output. As pandemic restrictions loosened worldwide and economies recovered, demand outpaced supply. That was ‘mostly attributable’ to the decision by OPEC Plus…to limit increases in production.”

- “Russia’s invasion of Ukraine has only compounded the issues.“

- “Absent the Keystone XL pipeline, crude oil imports from Canada have nonetheless increased by 70 percent since 2008, transported by other pipelines and rail. The Trump administration itself told PolitiFact in 2017 that the pipeline’s impact on prices at the pump ‘would be minimal.'”

- “The claims about oil and gas leases are even more incorrect. Though Mr. Biden temporarily halted new drilling leases on federal lands in January 2021, a federal judge blocked that move last June. In its first year, the Biden administration actually approved 34 percent more of these permits than the Trump administration did in its first year, according to federal data compiled by the Center for Biological Diversity, an environmental group.”

Now, here’s another excellent analysis, by Nobel Prize economist Paul Krugman at the NY Times, which again finds that it’s supply and demand on the world market, with basically zero impact in the short run by U.S. energy policy:

- “There are three things you need to know about gasoline prices. First, the price of crude oil — the stuff that comes out of the ground — is set in a global market, not country by country. Second, fluctuations in the price of gasoline, which is refined from crude, overwhelmingly reflect fluctuations in that global price. Third, U.S. policy has little effect on world oil prices, and virtually none at all in the short run — say, the 14 months that Biden has been in office.”

Next, here’s a piece at the WaPo, which finds:

- “As vaccines became available, people resumed commuting and sought a release from cabin fever through travel. After shutting down wells and laying off employees, De Haan said, oil companies have been slow to catch up to the rapid rise in gasoline demand. That caused prices to climb.”

- “Then, as Russia’s attack on Ukraine unfolded, the market began adding a risk assessment to the price of oil, making it spike...because Russia is a major producer on the world stage, volatility there makes oil prices rise globally”

- “Other factors have also hampered the supply of oil, he said, including labor shortages and supply chain constraints induced by the pandemic.“

- “…domestic oil production is more tied to pricing than to policy. ‘Before the invasion and during the pandemic, prices were low, and that did not motivate energy producers to go and drill more,” Gladden said. “But now that prices have skyrocketed … they’re ready to go drill because there’s a pricing signal there.'”

And then there’s this article from Forbes, which explains:

- “Was the [Keystone XL pipeline] KXL cancelation a contributing factor in the recent spike in oil and gasoline? Canceling the pipeline had a minimal effect on current prices.”

- “The global pandemic caused a significant disruption in global supply chains, including oil. Even though the global supply of oil may have declined during COVID-19, demand was also muted as people were afraid to travel. This kept oil and gasoline prices low. As the world began to emerge from the pandemic, demand increased. Even so, prices remained at the low end. Enter Vladimir Putin.“

- “This recent spike is not a product of President Biden. It is the culmination of many issues, with Russia’s aggression at the top of the list.”

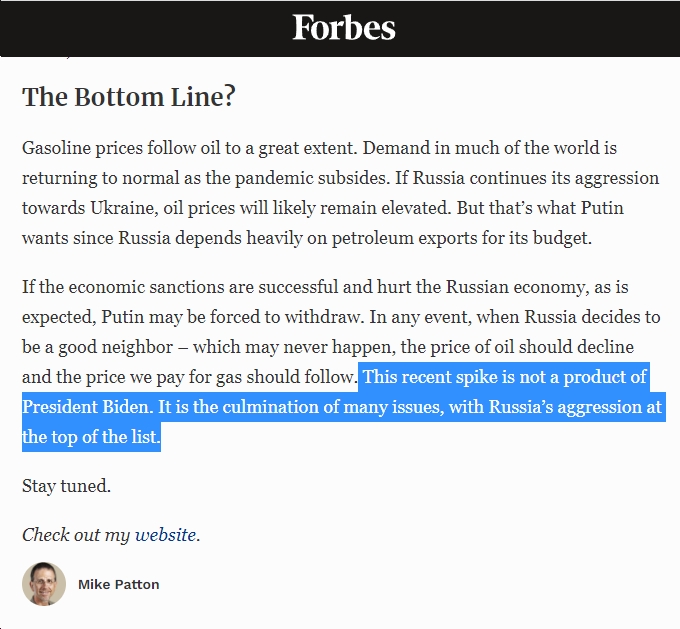

Finally, check this out from Matt Yglesias, showing that U.S. oil production is higher under President Joe Biden than under any other president in U.S. history. So…yeah, Democrats aren’t exactly killing U.S. oil production, as Republicans absurdly claim. Last but not least: of course, the answer to this entire problem is to GET OFF OF OIL by switching to a 100% clean energy economy as rapidly as possible, for a combination of economic, national security and environmental/climate factors. Yet again, Republicans are wildly wrong on this, while Democrats are generally pushing in the right direction (although obviously, having only 50 Democratic US Senators, one of whom is fossil-fuel-industry douchebag Joe Manchin, is a major problem).

![Sunday News: “Trump Is Briefed on Options for Striking Iran as Protests Continue”; “Trump and Vance Are Fanning the Flames. Again”; “Shooting death of [Renee Good] matters to all of us”; “Fascism or freedom? The choice is yours”](https://bluevirginia.us/wp-content/uploads/2026/01/montage011126.jpg)

![VA DEQ: “pollution from data centers currently makes up a very small but growing percentage of the [NoVA] region’s most harmful air emissions, including CO, NOx and PM2.5”](https://bluevirginia.us/wp-content/uploads/2026/01/noxdatacenters.jpg)

![New Year’s Day 2026 News: Full Video of Jack Smith Testimony – “The attack that happened at the Capitol…does not happen without [Trump]”; Trump/RFK Jr Make Measles Great Again; Right-Wing YouTuber Nick Shirley Definitely Not a Real Journalist; Musk Did Enormous Damage in 2025](https://bluevirginia.us/wp-content/uploads/2026/01/montage010126.jpg)