An AFL-CIO tweet yesterday jogged the memory. During the conclusion of Frontline’s series on the financial meltdown, the sorry tale of Larry Langford and Jefferson County, Alabama’s dance with derivatives had already created a question. With all of Delegate Purkey’s huffing about VRS, he’s never mentioned this.

An AFL-CIO tweet yesterday jogged the memory. During the conclusion of Frontline’s series on the financial meltdown, the sorry tale of Larry Langford and Jefferson County, Alabama’s dance with derivatives had already created a question. With all of Delegate Purkey’s huffing about VRS, he’s never mentioned this.

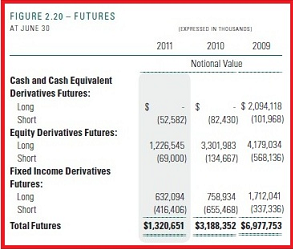

Readily available information is insufficient to determine if future Virginia retirees should consider themselves fortunate, but they seemed to have dodged the bullet during a flight to risk taken by their pension trust. Standard accounting and reporting procedures have changed since the meltdown of 2008, but what is clear is that at the end of the last available reporting period (June 30, 2011) the fund had unwound itself from a derivatives position of nearly $7 billion reported in 2009 to a much more reasonable (but not necessarily justifiable) $1.3 billion.

What Delegate Purkey (R-Virginia Beach) has claimed is the result of his committee’s hand on the steering wheel, The Virginia Retirement System reported a one year return on investment of 19.1% last year. But what the fund holds in assets is an amount less than that reported three years earlier: $51.3 vs $51.7 billion. So a three year decline of half a billion dollars. Not bad at all, considering the turmoil during that time.

But here are some questions:

- What was the net return on the derivatives?

- Was the risk inherent in the derivatives justified?

- If the return has justified the risk, why unwind?

- Would a flight to quality have provided a similar return without the risk?

One other question: Will Bob McDonnell repay VRS with the 33% two year gain the funds would have earned had they been paid when obligated?

![Sunday News: “Trump Is Briefed on Options for Striking Iran as Protests Continue”; “Trump and Vance Are Fanning the Flames. Again”; “Shooting death of [Renee Good] matters to all of us”; “Fascism or freedom? The choice is yours”](https://bluevirginia.us/wp-content/uploads/2026/01/montage011126.jpg)