Democrats currently face an enormous challenge of uniting a party that is hurt, angry, fractured and disoriented. The one uniting goal on the horizon is winning back the House and Senate in 2018. This involves overcoming enormous structural disadvantages such as gerrymandering and the current rotation of Senate seats, and strategically directing the resources necessary to win.

In the past month several groups on the left, using what appears to be 501(c)(4) status to hide their donors, (they actually don’t disclose on their donation form) have joined together for the “Not One Penny” campaign, a seemingly admirable effort to fight back against the Republican plans for tax reform. While they aren’t disclosing either the source of their money or the name of their executive director, the ‘dark money‘ group TaxMarch.org is being supported by a verifiable “who’s who” of Democrats. Run by a consortium of shared staff with hill, think tank, campaign, lobbying and activist experience. Really a pretty decent collection of talent.

Since the group is organized as an IRS 501(c)(4) organization, they can run whatever type of advocacy they want without disclosing donors. Some of the key players appear to be — MoveOn.org, Indivisible, Center for American Progress Action Fund, Communications Workers of America, Economic Policy Institute, Credo, both AFT & NEA, amongst many others… [Full List of Partners]

Unfortunately, even in the midst of the most important cycle of our lifetimes with a crazy man in the White House, this amazing collection of talent, resources and ad money is being spent to attack lifelong Democrats with misleading ads.

Any Democrat, even those who have fervently opposed Trump in every way, who offers an idea on Tax Reform is subject to the circular firing squad.

Rep. Tim Ryan, a Democrat from Youngstown, OH, who has tirelessly championed the causes of labor groups, college students, the poor, the middle class, our veteran’s, immigrants, the sick, and pretty much every constituency of the Democratic party – is now being targeted by TaxMarch ads. THE LEFT IS SHOOTING ITSELF ONCE AGAIN.

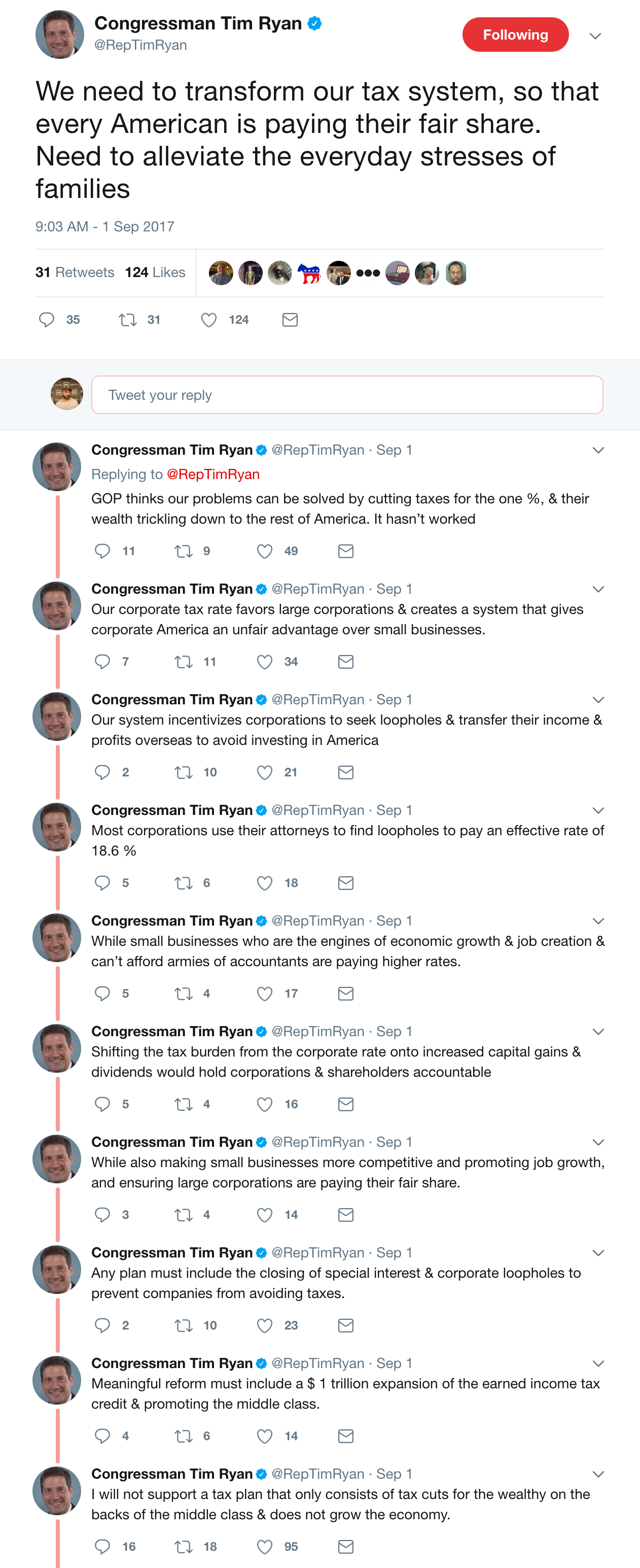

Putting aside the stupidity of infighting during the most important election cycle of our lives…. What did Rep. Tim Ryan actually say about corporate taxes? Rep. Tim Ryan did say he was willing to work with Trump and Republicans on the issue (AUDIBLE GASP). Don’t tell Schumer & Pelosi that their incredible feat was in fact a mortal sin to the left.

Beyond that, not much substantive was said. Feel free to google for some clippings, including a typically crappy piece in The Hill and some unusually bad reporting from Axios. The most in depth discussion was from Ryan’s official twitter account.

As a Democrat who grew up listening to Rep. Dave Obey rant about protecting the working class from Reagan, as a former hill staffer and veteran of several dozen campaigns, and now as the co-founder of a (very) small business… I’m struggling to disagree with any of what Rep. Tim Ryan said. If you do, please feel free to detail in comments, certainly worth a discussion, tho not an ad.

I fully agree with Tim Ryan, (as do both Hillary and Bernie) that we should raise capital gains taxes and close the loopholes that allow corporations to avoid paying taxes while small business get stuck with a disproportionate burden. On a somewhat interesting note, the well-heeled Democrats, many of whom are behind the funding of these ads, tend to be against Ryan’s calls for raising capital gains.

I also agree with Congressman Ryan that we need to do a massive expansion of the Earned Income Tax Credit (EITC) so that more families who have for generations lived in the bottom-quartile may finally break the cycle of poverty. So that they may spend the extra money to get out from under overdue bills, finally fix their car, pay off the ambulance ride that has been in collections for two years, and all the other chains that come with bumping along the bottom — problems that so many Democrats in Washington, especially those skilled enough to to employ IRS ‘dark money’ loopholes, have no understanding of beyond some brookings report and circulated talking point.

“GOP thinks our problems can be solved by cutting taxes for the one % their wealth trickling down to the rest of America. It hasn’t worked.” – Rep. Tim Ryan.

Correct. It hasn’t. What does work for Republicans though is fundraising while Democrats submit to their incessant need to shoot themselves in the foot. To eat their own. To conduct ideological purity test after purity test. Once again wasting time, talent and money while Republicans control both Congress and the White House.

Please, for the love of God, or hatred of Trump, or for the Dreamers, or for peace, or for the Supreme Court…

Let’s Focus on Winning Back the House & Senate.

2018 too far away for you and have some nervous energy or extra money? Get involved in Virginia 2017. Support Ralph Northam for Governor. (I’ve seen 3x as many Gillespie ads on tv, Ralph needs the money way more than any of these groups.) Contribute or volunteer for any of these races. Still have money leftover and feeling really antsy? Well before you go wasting it on attacking Democrats – consider supporting Blue Virginia‘s continued coverage of state and local politics. Or if you must, just fucking burn it.

————————

Full Disclosure:

In 2006 I did some fundraising and some web work for Rep. Tim Ryan in addition to Obey, Dingell, Conyers, and dozens of others. I also saw him out a couple times in my younger years at either the Tune Inn, Top of the Hill or Hawk n’ Dove, and can tell you that if personal relationships rely on both parties knowing who the other is, there’s no relationship. On the flipside, I, along with family members, have done work for and contributed to a few of these organizations and their affiliates in the past. I’m also sick of losing and watching limited resources being wasted on ridiculous in-fighting.

![Video: Former Eastern District of VA Federal Prosecutor Gene Rossi Asks, “Is Donald Trump going to be the lead counsel in that prosecution [of Jim Comey] and do the opening, closing and rebuttal? I pray that he does!”](https://bluevirginia.us/wp-content/uploads/2025/09/rossiedva-238x178.jpg)