Courtesy of USA Today:

Courtesy of USA Today:

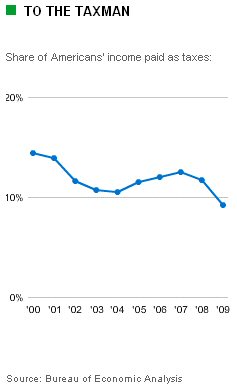

Amid complaints about high taxes and calls for a smaller government, Americans paid their lowest level of taxes last year since Harry Truman’s presidency, a USA TODAY analysis of federal data found.

Some conservative political movements such as the “Tea Party” have criticized federal spending as being out of control. While spending is up, taxes have fallen to exceptionally low levels.

Federal, state and local taxes – including income, property, sales and other taxes – consumed 9.2% of all personal income in 2009, the lowest rate since 1950, the Bureau of Economic Analysis reports. That rate is far below the historic average of 12% for the last half-century. The overall tax burden hit bottom in December at 8.8.% of income before rising slightly in the first three months of 2010.

“The idea that taxes are high right now is pretty much nuts,” says Michael Ettlinger, head of economic policy at the liberal Center for American Progress. The real problem is spending, counters Adam Brandon of FreedomWorks, which organizes Tea Party groups. “The money we borrow is going to be paid back through taxation in the future,” he says.

Actually, the “real” problem – and this is most definitely NOT difficult to comprehend, unless you’re trying not to comprehend – is our long-term, structural imbalance between expenditures (too high) and revenues (too low). On the expenditures side, it’s almost all health care and other “entitlements” spending, plus the military and interest on the debt. Other than that, “non-defense discretionary spending” is tiny and not growing significantly, so even if we wanted to cut all our national parks, roads and bridges, agricultural subsidies, education spending, homeland security, etc., we’d still face the same structural problems (e.g., aging population, skyrocketing health care costs) we do now.

Which brings us to the revenues side of the equation, where we’re at the lowest relative levels since 1950, despite fighting two wars (unpaid for), cranking up spending on “homeland security,” and dealing with the aforementioned health care cost spiral. In short, as much as the “taxed enough already” crowd wants to complain, the fact – and it is a FACT – is that taxes are actually very low by historical standards. Not that this will get in the way of the right wingers’ sob story; the facts rarely do with those people.

The bottom line is that, as much as conservatives think that all this is super complicated, a combination of rocket science and brain surgery, it’s actually very simple. To solve our huge budget problem, we need to rein in rising health care costs, pay for the wars we fight and security we require, and stop implying that we can all have “something for nothing” while maintaining the lowest tax rates in 60 years. Or, we can continue on our current path of borrowing from China and against future generations. But that would be as “nuts” as “the idea that taxes are high right now.”

![[UPDATED with Official Announcement] Audio: VA Del. Dan Helmer Says He’s Running for Congress in the Newly Drawn VA07, Has “the endorsement of 40 [House of Delegates] colleagues”](https://bluevirginia.us/wp-content/uploads/2026/02/helmermontage.jpg)