The financial reform bill passed by Congress includes restrictions on overdraft fees & limits “swipe fees” banks can charge stores. But the Senate blocked an amendment from Sen. Tom Harkin (D-IA) to restrict ATM fees.

The financial reform bill passed by Congress includes restrictions on overdraft fees & limits “swipe fees” banks can charge stores. But the Senate blocked an amendment from Sen. Tom Harkin (D-IA) to restrict ATM fees.

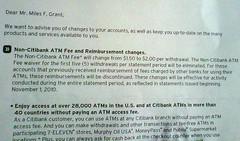

So guess what? To protect its multibillion dollar profits, Citibank just sent me a letter that it’s eliminating the thing that got me to sign up in the first place – free use of non-Citibank ATMs. Seemed like a good deal for both sides – Citibank got me to sign up & bank entirely online so it didn’t have to waste money on a location or tellers, I got to use any ATM I wanted. Now Citibank is reneging on its end of the deal (and I’m keeping my eyes open for a new one – if anyone loves their bank, please recommend it in comments.)

But I’m one of the lucky ones. Citibank & other big banks are also jacking up fees for people who don’t keep a high minimum balance or whose direct deposit is small. Those fees could reportedly reach up to $240 a year.

Obviously, if you can’t afford to keep a minimum balance or your direct deposit is small, you’re also going to be hit hardest by higher fees. Imagine losing your job & watching your checking account dwindle – only the lower it gets, the faster it evaporates thanks to minimum balance fees.

![Monday News: Trump’s Lunacy Pushes China, Russia, India, etc. Together; “Happy Labor Day. Donald Trump and Elon Musk Are Screwing Workers.”; “Where is the [media’s] intense focus on Trump’s failing health?”; ““Trump says he is not a dictator. Isn’t he?”](https://bluevirginia.us/wp-content/uploads/2025/09/montage0901-238x178.jpg)

![Monday News: Trump’s Lunacy Pushes China, Russia, India, etc. Together; “Happy Labor Day. Donald Trump and Elon Musk Are Screwing Workers.”; “Where is the [media’s] intense focus on Trump’s failing health?”; ““Trump says he is not a dictator. Isn’t he?”](https://bluevirginia.us/wp-content/uploads/2025/09/montage0901-100x75.jpg)