As we embark on the 2012 Budget Cycle fights, I felt it necessary to educate myself about effective tax rates for the top 400 earners and how the tax rates for the wealthy have changed over the years. I found an article

http://www.tax.com/taxcom/feat…

which I found to be quite enlightening.

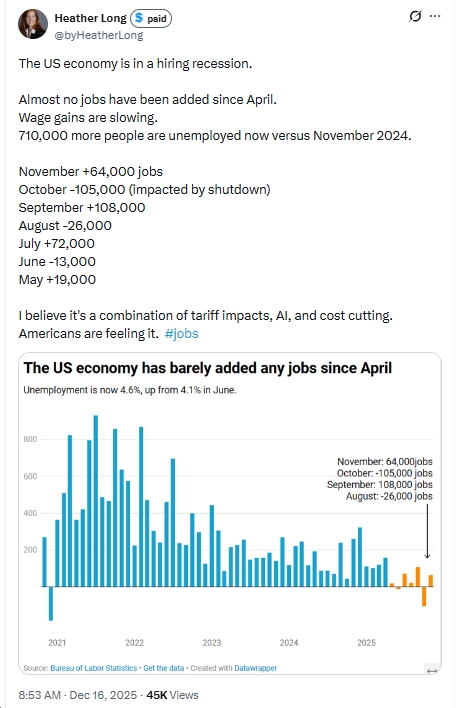

The long-term data show that under current tax and economic rules, the incomes of the top earners rise when the economy expands and contract during recessions, only to rise again. Their effective income tax rate fell to 16.62 percent, down more than half a percentage point from 17.17 percent in 2006, the new data show. That rate is lower than the typical effective income tax rate paid by Americans with incomes in the low six figures, which is what each taxpayer in the top group earned in the first three hours of 2007.

Please read that last sentence carefully. Taxpayers from the 95th to 99th percentiles (those earning in the low six figures) paid effective tax rates higher than those of the top 400 earners. These folks paid an effective tax rate of 17.52 percent, almost an entire percentage point higher than the top 400. The average daily income of the top 400 was a miniscule $945,000 per day. Three-quarters of their income was “earned” from capital gains and dividends and therefore taxed at 15%. Salaries and wages accounted for only 6.5 of income for the top 400.

The bottom 90% of income earners in the US saw their incomes rise from $29,577 in 1992 to $33,546 in 2007, a whopping 13%, while the top 400 incomes rose from $46,790 in 1992 to $344,759 in 2007…a piddly 399%. Snark! Their effective tax rates have dropped from 26.38 percent to 16.62 percent during this period. In 2007, 25 of the top 400 paid an effective tax rate of zero, nada, nothing, zilch! Another 127 paid an effective tax rate of 10 to 15%. ONLY 33 of the top 400 paid the federal minimum tax rate of 30 to 35%.

The top 400’s share of all income has grown from $.52 of every dollar earned by all Americans in 1992 to $1.59 of every dollar earned by all Americans in 2007. This pdf file illustrates just how much wealth has been transferred from the middle class to the top 400 earners since 1992. It is truly astounding.

http://www.tax.com/taxcom/feat…

And should we be surprised at this statement in the article:

The annual top 400 report was first made public by the Clinton administration, but the George W. Bush administration shut down access to the report. Its release was resumed a year ago when President Obama took office.

Of course President Bush would not want the working stiff to see how much wealth he was transferring from the middle class to the wealthy, therefore, he stopped access to the report.

My question about all of this is how do we ensure that the Democrats in the House and Senate fight to increase the tax rates for the wealthy and stop the transfer of wealth from the working class to the “high” class?

![Thursday News: “Europe draws red line on Greenland after a year of trying to pacify Trump”; “ICE Agent Kills Woman, DHS Tells Obvious, Insane Lies About It”; “Trump’s DOJ sued Virginia. Our attorney general surrendered”; “Political domino effect hits Alexandria as Sen. Ebbin [to resign] to join Spanberger administration”](https://bluevirginia.us/wp-content/uploads/2026/01/montage010826.jpg)