From the Commonwealth Institute:

Combined Reporting: A Key Tool to Limit Corporate Tax Avoidance

Next week, the Northam administration will give their annual presentation about the state’s finances to the legislature’s money committees. Preliminary reports indicate that state revenues came in above the official forecast for the fiscal year that ended in June.Although the numbers are higher than projected, Virginia’s revenues have not been keeping pace with overall economic growth. Investments require resources, and the state has many unmet budget needs, such as fully funding K-12 education. One way lawmakers can increase revenue is by reversing the erosion of Virginia’s corporate tax base. Currently, Virginia applies a flat 6% corporate income tax on corporate profits earned in the state, but how those “profits” are measured and taxed is not always straightforward.

Today, many large, multi-state corporations are able to use accounting maneuvers and exploit weaknesses in state tax structures to reduce their state tax bills, which puts a strain on state budgets. Corporations can relatively easily shift profits to states that tax it at lower rates – or not at all. For example, manufacturing corporations can set up subsidiary companies in low-tax states as suppliers of factory inputs. The parent company then pays the subsidiary an artificially high price for those inputs, which then get deducted as a business expense, reducing the parent company’s tax liability.

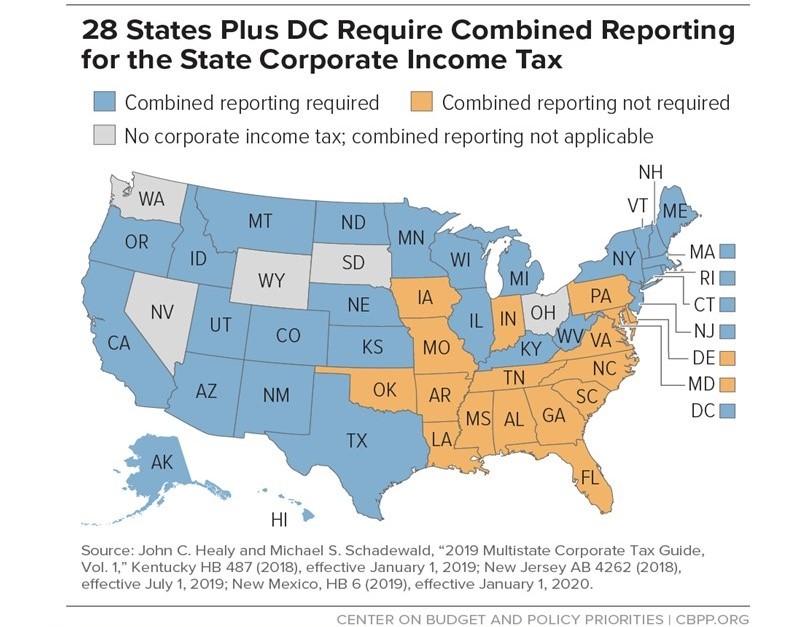

To counter this and similar practices, 28 states and D.C. have passed “combined reporting” laws. Combined reporting requires corporations to add up all of the income from the parent company and most or all of its subsidiaries. The member corporation(s) doing business in Virginia then would report the appropriate share of the combined profit on its state tax returns. The end result is that many common tax avoidance strategies are negated.

Enacting this reform also ends a tax advantage that locally-based corporations without out-of-state subsidiaries do not get. In terms of tax fairness, it places businesses on a more level playing field. This change would make sure large corporations pay their fair share in taxes, allowing the state to invest more in critical priorities. And for many of these large corporations, they already adhere to combined reporting requirements when filing taxes in one of the other states that has adopted this policy, so this will not be a new practice for them.

By enacting combined reporting, Virginia could gain between $80 million and $165 million a year in additional revenue.

- For context, with $165 million in new revenues the state could:

- hire sufficient school counselors to get us to nationally recommended caseloads ($88.2 million)

- fund the state’s share of pre-K for almost 13,000 four year-olds ($51.6 million), which equals the number of kids in families with an income below 200% of the federal poverty line (roughly $42,700 for a family of three) that currently do not have access to preschool.

- Or the state could choose to make significant improvements to increase health care access by:

- eliminating the “40-quarter rule” for legally residing immigrants, which would remove a barrier to coverage for many in the state ($6.5 million)

- improving dental access for adults with low incomes by adding a comprehensive dental benefit for Medicaid ($25 million before expansion)

- investing in health coverage for all children from low-income families, regardless of immigration status. We estimate this coverage to cost roughly $68 million annually if all children enroll based on most recently available data.

Alternatively, the state could:

- cover most of the cost of raising the wages of every state employee and employees of state contractors to $15 an hour, helping make sure that public servants are being paid enough to live with dignity.

In the past, there has been some legislative interest in adopting combined reporting in Virginia. During the 2010 and 2012 General Assembly sessions, bills were introduced that would have required combined reporting for state tax purposes. And during the 2017 session, a proposal (HJ 638) would have directed the state’s Department of Taxation to research combined reporting and develop recommendations for its implementation in Virginia. None of these measures advanced.

As lawmakers take stock of the state’s revenue and budget picture, they also need to take steps to make sure Virginia has a modern revenue system – one that keeps pace with changes in the overall economy. As corporate structures have become more complex, combined reporting is a critical policy tool with which to limit corporate tax avoidance.

— Chris Wodicka, Policy Analyst

![Thursday News: “Europe draws red line on Greenland after a year of trying to pacify Trump”; “ICE Agent Kills Woman, DHS Tells Obvious, Insane Lies About It”; “Trump’s DOJ sued Virginia. Our attorney general surrendered”; “Political domino effect hits Alexandria as Sen. Ebbin [to resign] to join Spanberger administration”](https://bluevirginia.us/wp-content/uploads/2026/01/montage010826.jpg)