It’s hotter than hell around the world, with the five-year period ending in 2019 “slated to be the hottest of any five-year period on record.” Meanwhile, a new climate report by the Nobel Peace Prize-winning IPCC finds that (bolding added by me for emphasis):

- “The global ocean has warmed unabated since 1970 and has taken up more than 90% of the excess heat in the climate system”

- “Global mean sea level (GMSL) is rising, with acceleration in recent decades due to increasing rates of ice loss from the Greenland and Antarctic ice sheets”

- “Changes in the ocean have impacted marine ecosystems and ecosystem services with regionally diverse outcomes, challenging their governance”

- “Global-scale glacier mass loss, permafrost thaw, and decline in snow cover and Arctic sea ice extent are projected to continue in the near-term (2031–2050) due to surface air temperature increases (high confidence), with unavoidable consequences for river runoff and local hazards (high confidence). “

- “Over the 21st century, the ocean is projected to transition to unprecedented conditions with increased temperatures (virtually certain), greater upper ocean stratification (very likely), further acidification (virtually certain), oxygen decline (medium confidence), and altered net primary production (low confidence).”

- “Sea level continues to rise at an increasing rate. Extreme sea level events that are historically rare (once per century in the recent past) are projected to occur frequently (at least once per year) at many locations by 2050 in all RCP scenarios, especially in tropical regions (high confidence). The increasing frequency of high water levels can have severe impacts in many locations depending on exposure (high confidence).”

- “Risks of severe impacts on biodiversity, structure and function of coastal ecosystems are projected to be higher for elevated temperatures under high compared to low emissions scenarios in the 21st century and beyond. Projected ecosystem responses include losses of species habitat and diversity, and degradation of ecosystem functions.”

There’s a lot more, but the bottom line is this is: a) a crisis; b) 100% human-caused; c) requiring urgent, immediate, dramatic policy action at every level – corporate, local government, state government, federal government, etc. That action includes, among other things (e.g., changes in land-use, forestry and agricultural practices), a transition off of fossil fuels to clean energy as rapidly as possible. If we want to maintain a habitable planet, that is. Which, presumably, all of us who aren’t fossil fuel company executives absolutely do want.

So the thing is, we don’t even need to get into economics to make the case for ditching fossil fuels ASAP. The climate crisis, and other environmental concerns related to fossil fuels, should be more than sufficient to lead to the no-brainer conclusion here. Still, the profit motive – and economics more broadly – is a powerful motivator, and in this case it should be yet *another* powerful reason to switch to clean energy. That includes, of course, not investing in new fossil fuel projects, such as the two fracked-gas pipelines (the Atlantic Coast Pipeline and the Mountain Valley Pipeline) being built here in Virginia.

How bad are these pipelines from an economic perspective? Two recent reports by the highly respected Rocky Mountain Institute (RMI) tell us the answer: crazy bad. Check it out:

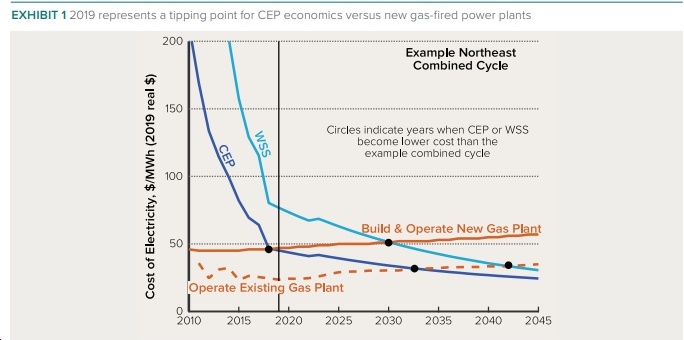

- “Two new reports from Rocky Mountain Institute (RMI) analyze the economics of

over US$100 billion worth of planned investment in new gas-fired power plants and

interstate gas pipelines in the United States, in the context of rapidly-declining costs

for renewable energy and battery storage technologies. The reports find that the role of gas as a ‘bridge fuel’ is behind us; there are both significant cost savings opportunities if US utilities prioritize clean energy over continuing their present rush to gas, as well as existential risks facing investors that continue spending on new gas infrastructure.“ - “The economics guiding US investments in electricity generation have reached a historic tipping point: combinations of solar, wind, storage, efficiency and demand response are now less expensive than most proposed gas power plant projects. According to a new report by Rocky Mountain Institute (RMI), portfolios of these clean energy resources can provide the same energy and reliability services as traditional gas power plants—but cost less.”

- “Currently, there is an estimated $90 billion of planned investment in new gas-fired power plants and over $30 billion of planned investment in proposed gas pipelines. If clean energy replaces the proposed gas plants, consumers could save $29 billion, according to the report, The Growing Market for Clean Energy Portfolios.”

- “By the mid 2030s, as clean energy prices continue to fall, building a new portfolio of clean energy resources will become less costly than continuing to pay the operating costs of a combined-cycle gas plant, and such a portfolio will provide the same level of energy, capacity and reliability services.”

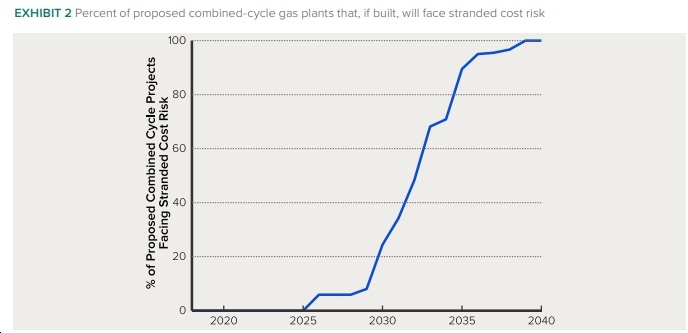

- “These cost trends could lead to the economic retirement of plants representing over 90% of currently proposed new combined-cycle gas capacity by 2035, resulting in a significant risk of investment capital becoming stranded. Just as coal plants have retired due to competition from low-priced natural gas in the past 10 years, the ongoing cost declines in wind, solar and battery technologies threaten to do the same to natural gas plants by the mid-2030s, according to the report.”

- Another new report by RMI, “Prospects for Gas Pipelines in the Era of Clean Energy, shows that power plant gas use has driven the overall increase in US natural gas consumption over the past 20 years—expectations that this growth will continue underpin the economics of proposed new pipelines.”

- “…because clean energy already outcompetes gas power plants and will soon lead to their early retirement, the underlying economic justification for new pipelines is now in question. The report finds that over 95% of gas use in proposed gas-fired power plants across much of the eastern United States could be economically offset by clean energy by 2035, reducing the utilization of proposed new gas pipelines by between 20% and 60%.“

- “This reduction in gas flowing through new pipelines would, in turn, dramatically increase the costs that customers or shareholders will face in continuing to operate these pipelines. The report identifies the risk of a ‘death spiral,’ where declining sales volume leads to higher prices, which in turn lead to further declines in sales. This reinforcing feedback loop would only end when pipeline projects go bankrupt and/or cease operations altogether.”

The bottom lines, as the website DeSmog Blog writes, are that: 1) “Much like coal, the economics of natural gas production in the U.S. and Canada are unsustainable, and the writing is on the wall for all those willing to read it.“; 2) “…not only is natural gas bad for the climate and environment, but like coal, it’s a bad investment. Whether and how quickly society at large comes to terms with these realities could mean all the difference for the future of a livable climate.”

So, given all this, when the hell is Virginia going to do everything it can to cancel the Mountain Valley Pipeline and Atlantic Coast Pipeline boondoggles? Clearly, the governor, state legislators, State Corporation Commission, Department of Environmental Quality, etc., don’t need any additional information to know what a disaster these projects are and will be. So again, what on earth are they waiting for? Remember, there’s no Planet B, so we’d better not screw this one up.

P.S. These graphs are very clear that “Clean Energy Portfolios” (CEP) and Wind/Solar/Storage are either already at the cost of new gas-fired power plants or will be in a few years, meaning that an increasing percentage of new gas-fired power plants and pipeline infrastructure will likely be economically “stranded” in coming years. Which, obviously, means that these projects make little if any economic sense.

![Wednesday News: “The Grand Opening of an American Concentration Camp”; Trump Threatens to Arrest Mamdani; “Poorest Americans Would Be Hurt By Trump’s Big Bill”; [VA] GOP nominees share stage, but not unity”; “Hoos your daddy, Virginia?” (Not Youngkin)](https://bluevirginia.us/wp-content/uploads/2025/07/montage0702.jpg)