From the Commonwealth Institute for Fiscal Analysis

Last week, the 2020 General Assembly session reached the point of the legislative calendar known as “crossover.” From crossover until the end of session, the House of Delegates only considers legislation that has passed the Senate, and the Senate only considers legislation that has passed the House (the lone exception is the budget bill). Although many significant state tax policy bills filed for this year did not move beyond the committee level, several proposals remain under consideration. A large transportation funding package (HB 1414 and SB 890) and several standalone regional transportation funding bills have advanced from their respective chambers in the Virginia General Assembly. In addition, proposed increases to cigarette and tobacco taxes are included as part of the House and Senate budget proposals.

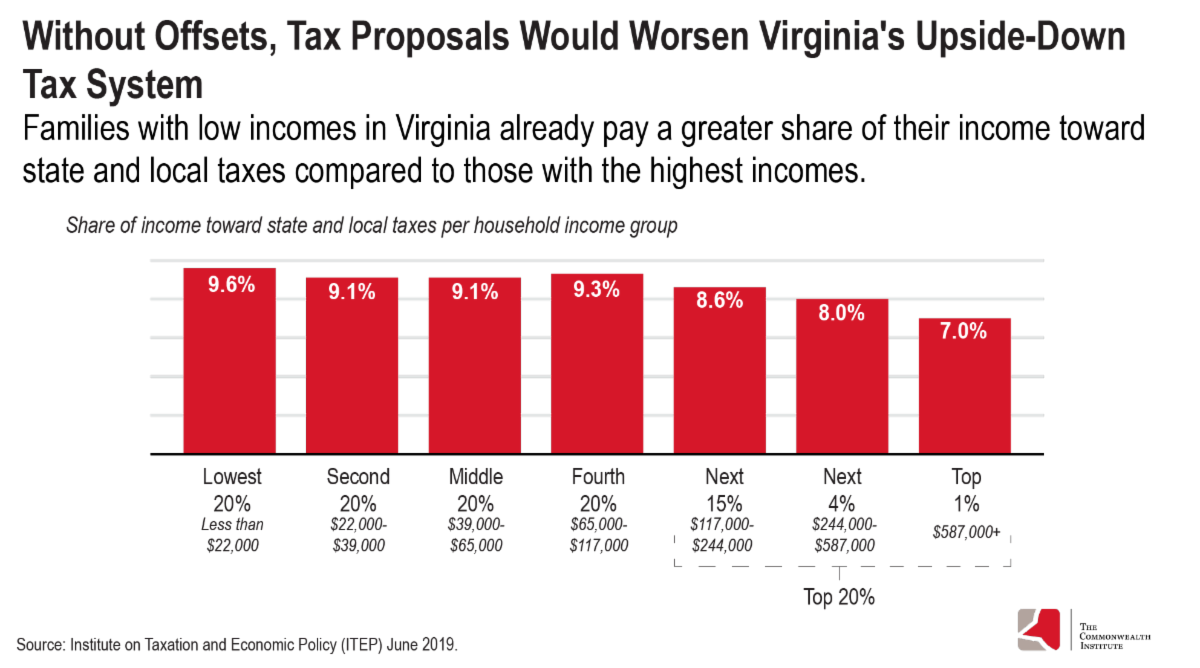

These transportation bills would generate needed new revenues for transportation projects across the state, including public transit. However, in their current form, several of these and other proposals, such as increased cigarette taxes, would worsen Virginia’s already upside-down, or regressive, tax system (where families with the lowest incomes pay the highest share of their income toward state and local taxes on average, while those with the highest incomes pay the lowest share). Lawmakers should make sure that proposed offset measures, such as fee reductions, are included in the final version of the legislation.

State and regional transportation funding

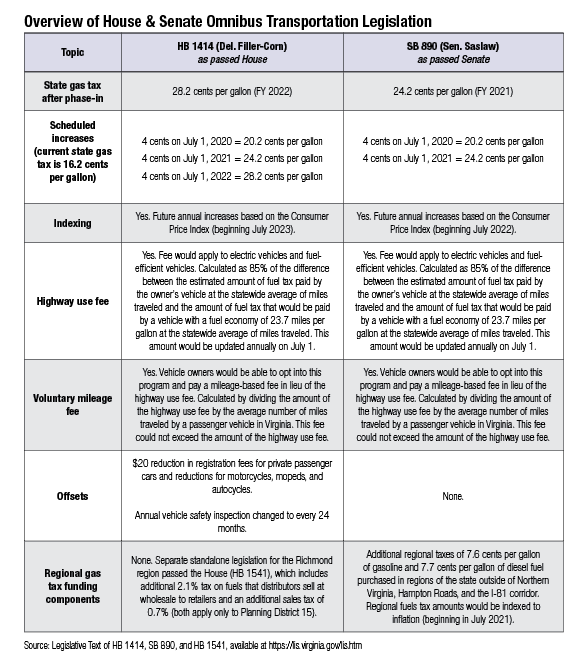

As initially proposed by the governor, the statewide transportation funding overhaul would increase state gasoline taxes by 4 cents per year for the next three years (12 cents total) and grow along with inflation after that. The governor proposed eliminating the state’s annual vehicle safety inspection requirement and reducing annual vehicle registration fees, which would offset most of the impact of the gas tax increase for state residents. In addition, the legislation would establish a new highway use fee and voluntary mileage-based user fee program, which would place new fees on owners of electric and fuel-efficient vehicles.

In contrast to the governor’s original proposal, the House version (HB 1414) retains the state vehicle safety inspection but changes it from an annual requirement to every two years. The Senate version includes larger differences. As passed in the Senate, the Senate bill (SB 890) eliminates the third year of the proposed gas tax increase, so that gas taxes would increase by a total of 8 cents per gallon after two years (and be subsequently adjusted for inflation). The Senate bill also adds an additional regional fuels tax of 7.6 cents per gallon of gasoline and 7.7 cents per gallon of diesel fuel purchased in regions of the state that do not already have an additional regional fuels tax. (Northern Virginia, Hampton Roads, and the I-81 corridor already have regional fuels taxes.) Regional fuels tax amounts would also be indexed to inflation. The Senate transportation bill also retains the annual safety inspection and keeps annual vehicle registration fees at their current level, while another Senate bill (SB 972) would increase the registration fee by $4. Additional revenue from the increase would go to the State Police.

The versions of SB 890 and a corresponding vehicle safety bill (SB 907) that passed the Senate do not contain offsets to reduce the impacts of the tax increases on families with low incomes. For simplicity, the Senate could offset much of these impacts by mirroring the House legislation and including reductions in annual registration fees or other fees that are flat dollar amounts paid by state drivers. An alternative approach would be to address these impacts through tax credits for families with low and moderate incomes, such as an Earned Income Tax Credit (EITC). Virginia created its current EITC as part of the 2004 tax reform package that included sizable increases to the state cigarette tax. Several states also offset regressive sales and excise taxes with modest refundable credits, such as Arizona’s “Increased Excise Tax Credit,” Idaho’s “Grocery Credit,” and Maine’s “Sales Tax Fairness Credit.” These kinds of credits would also help to make sure that families with low or moderate incomes would not face disproportionately higher taxes.

Several standalone regional transportation bills have also passed:

- One bill (HB 1541) would create a new transportation authority for the Richmond region to fund road projects and provide new investments for public transit.

- House (HB 1726) and Senate proposals (SB 1038) to fund a new transit program in the Hampton Roads region have passed, although the House version includes a clause that the bill will only go into effect if similar legislation is passed during the 2021 session. The Senate version as passed did not include this clause.

- A House bill (HB 729) would adjust transportation funding in Northern Virginia, including regional funds directed to the Washington Metropolitan Area Transit Authority.

- A Senate proposal (SB 452) would add an additional fuels tax on a regional basis, similar to the regional funding provision contained in SB 890.

Cigarette and tobacco taxes

The House and Senate budget proposals include the governor’s proposed increase to cigarette and tobacco taxes. This would increase the cigarette tax from 30 cents per pack to 60 cents per pack and impose a tax of 6.6 cents per milliliter of liquid nicotine. The House and Senate budgets include clarifying language, such as specifying that a corresponding increase on other tobacco products also goes into effect in July.

Cigarette taxes are also regressive. To address this, these tax revenues have been paired in the past with credits like the EITC or were directed toward health care funding for people with low incomes. For example, in 2004, Virginia paired increased sales and cigarette taxes with creation of a nonrefundable EITC and a new fund for health care.

Sports gambling, lottery, and “games of skill”

Both the House and Senate have passed bans on “games of skill” (HB 881 and SB 971). The governor’s budget assumed that legislation to regulate and tax these devices would be enacted and generate about $125 million in new revenue over the two-year budget. The House and Senate have revised lottery forecasts upward to partially offset the decrease in these gaming revenues and the House has invested $45 million from the state’s General Fund into a supplemental lottery program to fully offset the change.

In addition, both chambers have passed legislation to authorize sports gambling and online lottery ticket sales (HB 896 and SB 384). The House bill would generate about $21 million and $31 million in the budget year that begins July 1, 2020 (fiscal year 2021) and in fiscal year 2022, respectively. These funds would be directed to the Lottery Proceeds Fund, the state General Fund (GF), and a gambling treatment and support fund. The Senate bill would generate about $10 million and $19 million in FY 2021 and FY 2022, respectively, with most of the funds directed to state reserves and smaller portions deposited into a Sports Betting Operations Fund and a gambling treatment and support fund.

The House budget assumed about $37 million in new GF revenue from sports gambling legislation. The Senate budget assumed additional revenues, most of which ($27 million) would be deposited into state reserves.

Local revenue options

Two proposals (HB 785 and SB 588) have advanced that would largely equalize taxing authority for Virginia’s counties. These bills would allow counties to have greater access to revenue sources, including admissions, meals, transient occupancy, and cigarette taxes, and shift away from reliance on real estate and personal property taxes. As passed by the House, HB 785 would allow counties greater latitude to levy cigarette taxes, while SB 588 (as passed by the Senate) caps these amounts at 40 cents per pack. By expanding revenue options for local governments, this will give them greater ability to meet state required spending for items such as public education.

Progressive tax proposals

- A proposal to strengthen Virginia’s EITC by making it fully refundable, which would have provided an additional tax refund to working families with low and moderate incomes in the state (HB 1435)

- Multiple proposals to reform the state corporate income tax by adopting unitary combined reporting and minimize corporate tax avoidance opportunities (HB 739, HB 1109, SB 756)

- Two proposals to restore the state estate tax that would have applied to the largest estates in Virginia (those valued at $11.58 million or more), which include substantial amounts of capital gains income that has escaped state taxation (HB 736 and SB 637)

- A proposal to annually update the state individual income tax code for inflation to prevent inflation from eroding key tax measures, such as the standard deduction and personal exemptions (HB 735)

As state lawmakers work to finalize 2020 tax policy legislation, they should consider ways to address the regressivity of these proposals, either by establishing offsets for families with low incomes or by directing more funding to public investments that would boost opportunity for households with low income or low wealth.

— Chris Wodicka, Policy Analyst

Print-friendly Version (pdf)

![Video: Sen. Mark Warner Says Last Night, “you saw an angry old man [Trump] giving a partisan screech that doesn’t solve anything”](https://bluevirginia.us/wp-content/uploads/2025/12/warner1218-100x75.jpg)